Greece presents its hydrocarbon treasure potential

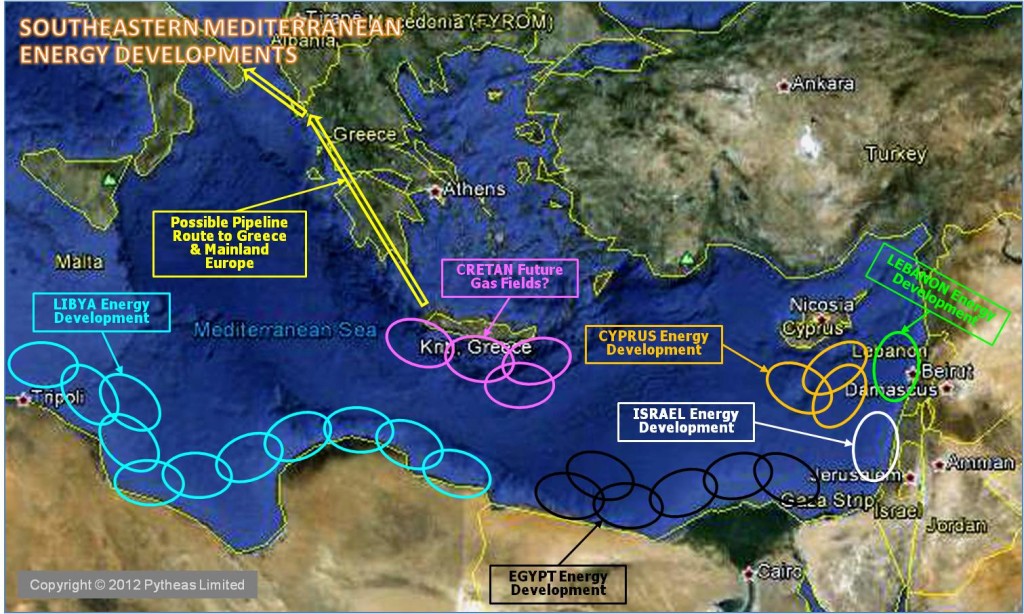

Israel, Lebanon and Cyprus have managed to alter the strategic calculations over Europe’s future energy security, following the confirmation of the hydrocarbon reserves under the southeast Mediterranean seabed.

With concerns over developments in the Middle East and Russia, European governments and big oil companies are more than keen to explore new energy sources.

Greece has decided to join in and put into good use the encouraging seismic research data pointing to potentially significant oil and gas reserves in the Ionian Sea and south of Crete.

The presentation of the data, the newly drawn map of 20 hydrocarbon blocks covering an area from the north of Corfu to Cythera and from the west coast of Crete to the southeasternmost tip of the island and the terms of the international licensing round due to start in July took place in London, by a delegation headed by the Environment and Energy Minister Giannis Maniatis.

The intense interest in the area paid off for Greece, as the Hellenic Centre hall which hosted the two-day conference reached capacity, with around 40 large and medium energy companies being represented by two or more experts. What particularly satisfied the Greek ministry team was the fact that companies such as Exxon Mobil, Chevron, Total and BP were among those that had requested private meetings with the Greek experts. The meetings were mostly held on the second day of the event and focused on clarifications over geophysical, geological and other technical analyses. BP clearly stated that it is interested in participating in the licensing round, according to the Greek minister.

Energy analysts present at the event told IBNA that there is genuine interest by the big players for the Greek energy prospect, which however will need to be nurtured in order for the country to be actively included in the league of countries that are changing the energy landscape of Europe.

Greek officials reassured the interested parties that the government is serious about exploiting the new field in full, based on a clear and steady plan. Asked by this agency about what he considered to be the most attractive elements of the package that Greece has to offer to potential energy investors, Mr Maniatis pointed to factors such as the tax framework, the support of local communities and the reassurance over the government’s determination to ease the investment climate in the long run.

“First we offer a low taxation regime, a 25% tax of which 5% will be a regional tax benefiting the local communities. This fact on its own, this reciprocal benefit for the locals means a lot to an investor. And thirdly, companies will be drawn in because of the demonstration of our determination to keep all terms of the deal unchanged over the next decades,” said the minister.

As for what all this means for the crisis battered country, Mr Maniatis risked an estimation over the potential economic profit for Greece. “All experts advise politicians to avoid uttering such estimates,” quipped the Greek minister when prompted by journalists. “Nevertheless,” he continued, “we believe that looking at around 30 years’ time from now we can have an average income between 40% and 60% in total from each of the exploited hydrocarbon blocks. If the confirmatory drillings do confirm the seismic research data, then we are talking about a prospect of tens of billions for many decades,” said Mr Maniatis.