Blackbird Energy: Buy The Rumor, Sell The News

Summary

Blackbird Energy is an emerging explorer targeting the Montney formation in Canada.

Thanks to its first two Montney wells, the company garnered increased attention over the last months.

Hype and speculation pushed the company’s valuation to sky high levels.

The drilling results were released just a few days ago disappointing the investors who dumped the stock and hit the exits.

(Editor’s Note: Investors should be mindful of the risks of transaction in securities with limited liquidity, such as BKBEF. Blackbird Energy’s listing in Canada, BBI.V, offers stronger liquidity.)

Introduction

There is an old Wall Street proverb saying “buy the rumor, sell the news” when stocks trade up into “big” announcements and carry an inflated valuation, but sell off shortly thereafter, because short-term traders bail and speculators sell as well.

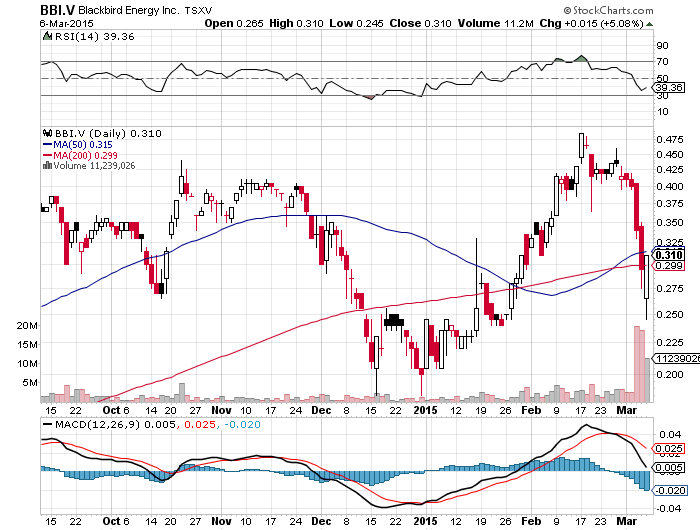

And, this is the case with Blackbird Energy (OTC:BKBEF), as illustrated below:

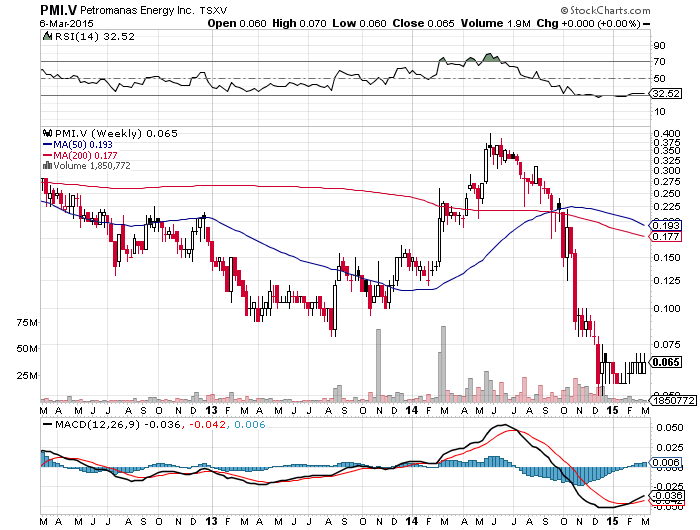

History repeats itself of course and I saw the same pattern just a few months ago. Petromanas Energy (OTCPK:PENYF) was drilling a high-impact well (Molisht-1) in Albania in H1 2014, and the expectations were very high. The investors set high expectations because several bullish reports were sayingthat “Shell needs Petromanas’ big play”, “in Albania, the geology is similar to southern Italy, home to some of Europe’s largest onshore fields that host between 300 million and 500 million barrel” and “Shell needs multi-hundred million barrel discoveries to move the needle and clearly Shell thinks it has a good chance of finding something like that in Albania”.

As a result, Petromanas’ market cap skyrocketed reaching almost C$280 million in June 2014, although Petromanas was an explorer with zero commercial production back then.

Shell (NYSE:RDS.A), Petromanas’ JV partner, encountered several challenges during the drilling process that finally made it suspend the well in H2 2014. And, Petromanas’ performance between H1 and H2 2014 is illustrated below:

The Assets

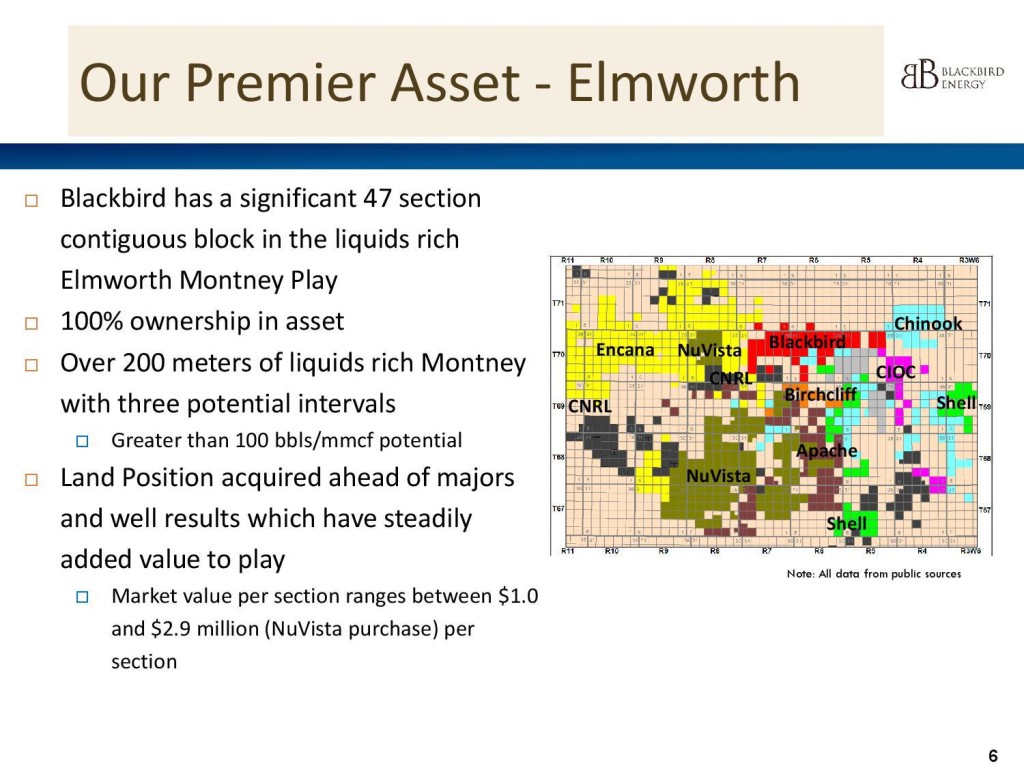

Blackbird Energy is an emerging Canadian explorer whose core property (Elmworth project) is located in the Montney fairway in Alberta, as illustrated below:

Blackbird was created in its current form in early 2014 through the acquisition of Pennant Energy. As shown above, Shell , Apache (NYSE:APA), Canadian Natural Resources (NYSE:CNQ), Encana (NYSE:ECA), NuVista Energy (OTC:NUVSF), Chinook Energy (OTC:CNKEF), Birchcliff Energy (OTCPK:BIREF) and privately-held Canadian International Oil own significant acreage in the same area, which could made Blackbird a potential takeover target in case Blackbird’s acreage contained hydrocarbons in commercially viable quantities.

The Business Plan, The Articles And The First Results

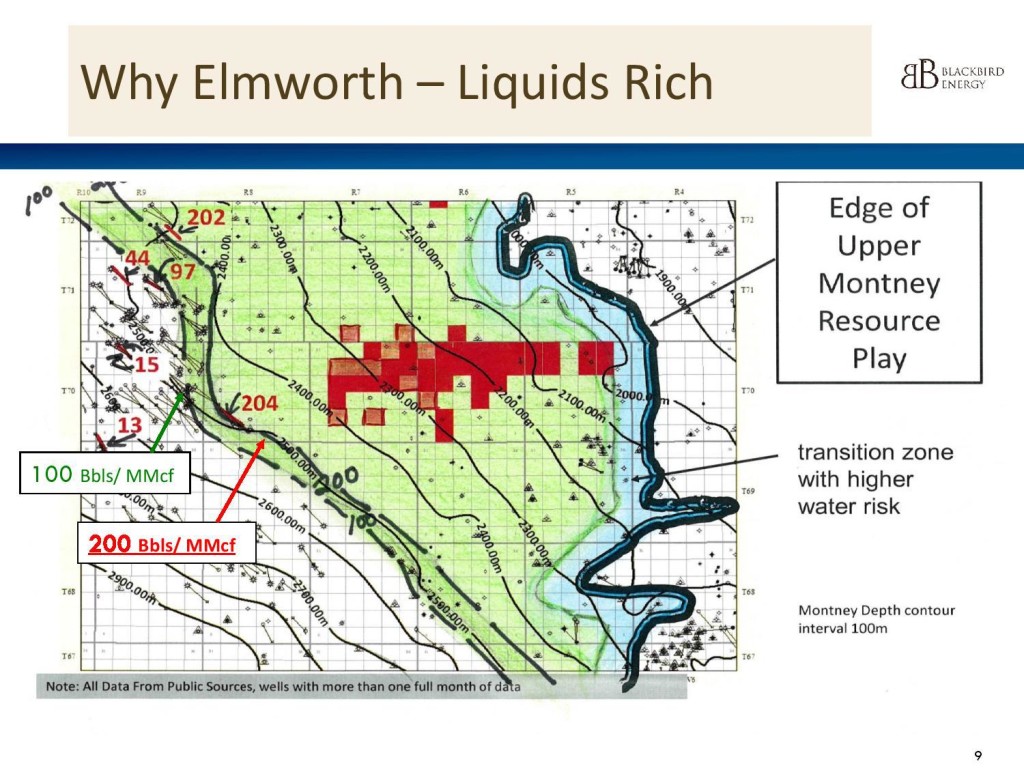

Since the completion of the merger, the new entity has changed its business plan and has decided to focus on the Montney formation. Therefore, Blackbird plans to grow through the drill bit with the hope to become a junior Montney producer over the next months. Blackbird believes that its properties carry superior economics thanks to their high liquids/gas ratio. Actually, Blackbird estimates that its wells contain between 100 and 200 bbls/mmcf, as illustrated below:

Back in October 2014, the company completed two financings at a price of C$0.29 per special warrant and C$0.34 per Flow-Through share for total gross proceeds of approximately C$30.4 million.

That was also the time when the company announced a high impact multi-well drill program targeting both the Upper and Middle Montney. The first well would target the Middle Montney at Elmworth on or before November 1, 2014. The second high impact well would target the Upper Montney interval and would be drilled from the same drill pad as the Middle Montney well.

In December 2014, the company completed another private placement. The aggregate amount of shares issued pursuant to both tranches of that private placement was 16,150,555 at a price of C$0.45 per flow-through share for aggregate gross proceeds of C$7.27 million.

Meanwhile, the first article about Blackbird was syndicated in May 2014. That article was followed by two articles in September 2014, one article in October 2014, two articles in January 2015 and two articles in February 2015. Actually, these are the articles I found while I was doing my due diligence on Blackbird, but I might have missed some of them.

The last seven articles were touting the company’s Montney acreage while one of them claimed that Blackbird could exit 2015 with a production between 5,000 boepd and 7,300 boepd. And, Blackbird was fully aware of these seven articles. Actually, the company was a client of the three websites that published these seven articles between September 2014 and February 2015, according to the disclosures below:

“Blackbird Energy Inc. paid The Energy Report to conduct, produce and distribute the interview. Garth Braun had final approval of the content and is wholly responsible for the validity of the statements. Opinions expressed are the opinions of Garth Braun and not of The Energy Report or its officers”.

and below:

“Legal Disclaimer/Disclosure: Blackbird Energy is an Oilprice.com client. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment”.

and below:

“Blackbird Energy Inc. paid Streetwise Reports to conduct, produce and distribute the interview”.

As usual, speculation and hype made the investors pile into the stock, pushing it at sky high levels in February 2015. The stock went from C$0.20 to C$0.49 in just two months, and the company’s market cap skyrocketed reaching C$173 million (based on approximately 354 million basic outstanding shares pro forma the latest placement).

The disappointing drilling results from the first two Montney wells were released last week and the stock plunged. According to these results:

1) The first well flowed at a rate of approximately 407 boepd (44% liquids), including 1.36 mmcf/d of natural gas, 133 bbls/d of 50 degree API condensate and an estimated 47 bbls/d of plant recoverable natural gas liquids, for a total liquids to gas ratio of 133 bbls/mmcf.

2) The second well flowed at a rate of approximately 466 boepd (67% liquids), including 0.9 mmcf/d of natural gas, 281 bbls/d of 46 degree API condensate and an estimated 32 bbls/d of plant recoverable natural gas liquids for a total liquids to gas ratio of 341 bbls/mmcf.

From an operational perspective, further testing is planned following spring break-up to help evaluate the wells’ potential. From a fundamental perspective, Blackbird currently holds approximately C$27 million in cash post drill and complete of these two Montney wells, and has zero debt.

A debt-free energy company is always a very good starting point, given that debt overhangs affect several energy companies these days pushing them to the verge of bankruptcy. And, I presented some of these companies in my previous articles here and here.

On the flip side, there are two key disadvantages with the Blackbird story:

1) At the current price of C$0.31 per share, the market cap is C$110 million and the enterprise value is C$83 million or US$67 million (1 USD=1.25 CAD). To me, this remains a rich valuation for an explorer with uncharted land and two disappointing drilling results.

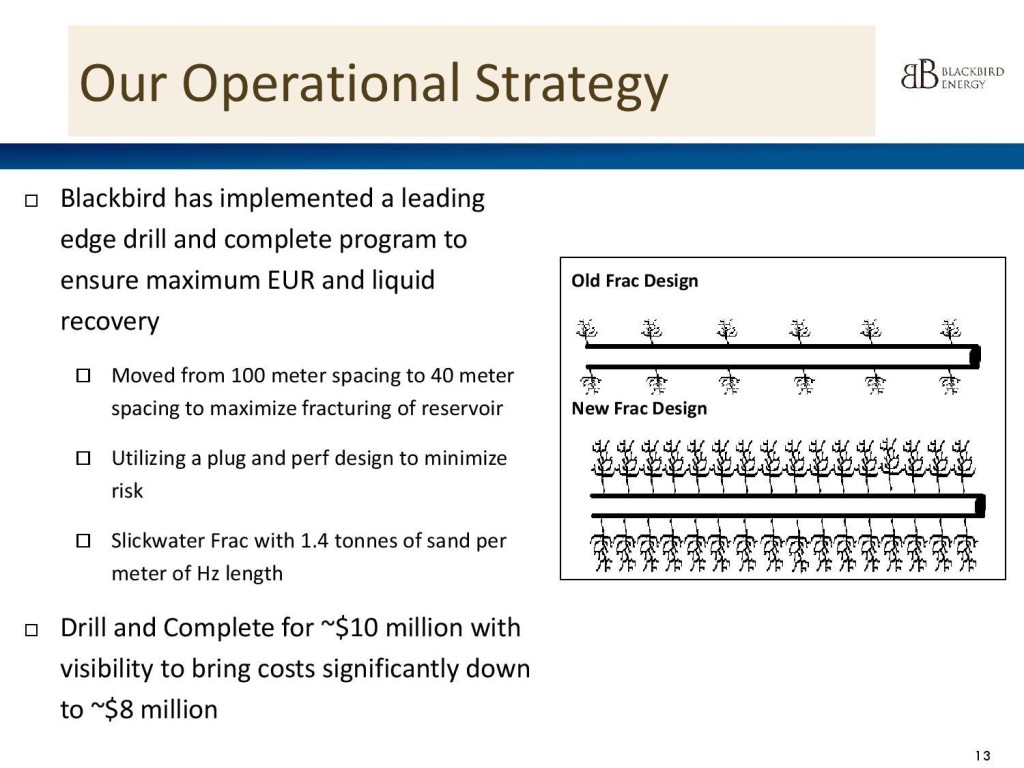

2) Blackbird’s Montney wells are expensive and therefore, Blackbird has little or no margin for error. Over the next months, it has to be very careful not to make mistakes while deploying its remaining limited capital to the Montney play, given that the D&C cost per well is approximately US$10 million, as illustrated below:

My Takeaway

Blackbird Energy is an emerging explorer that started to de-risk the Upper, Middle and Lower Montney in Canada in late 2014. That was the time when several articles added a lot of excitement to the Blackbird story and the stock price took off reaching C$0.49.

However, the drilling results from the first two Montney wells were disappointing, and many investors dumped their shares last week bringing the company’s enterprise value at US$67 million (1 USD = 1.25 CAD) at the current price of C$0.31.

To me, this is still a very rich valuation despite the 40% correction. I am saying this because I see the big picture in the sector with the help of the relative valuation models. And, the recent slump in the oil price has brought some quality energy producers with zero net debt at absurdly low valuations, while Blackbird Energy remains a speculative-grade explorer that has still a lot of work to do in order to de-risk its assets during the remainder of 2015.

Therefore, I am not willing to pay US$67 million for a risky explorer, when I can buy with the same amount of money proven producers with a rock solid balance sheet.

For instance, Petroamerica Oil (OTCPK:PTAXF) is an established producer of 5,500 boepd (98% oil) with a pristine balance sheet while also being a potential takeover target, as presented in one of my recent articles. But, the turmoil in the energy sector punished the Innocent along with the Guilty bringing Petroamerica’s enterprise value at US$75 million (1 USD = 1.25 CAD) at the current price of C$0.14.

Alternatively, if some investors are thrilled by the idea of owning shares in an explorer, they need to check Petrodorado (OTC:PTRDF) whose market cap is only US$5.8 million (1 USD = 1.25 CAD) at the current price of C$0.15, although Petrodorado has US$17.5 million in cash with no debt and extensive acreage right next to producing oil fields in Colombia, as presented in my Instablog article.

In other words, my investment motto is to get more for less. Paying more to get less is not for me. Therefore, I am not going to touch Blackbird at the current levels because I have way better investment choices from the energy sector. I will stay on the sidelines and I will continue watching how the Blackbird story will unfold over the next months.