Iran’s gas plans for Caucasus

Iran says it is preparing to triple gas exports to Armenia, start exports to Georgia and store its gas in Azerbaijan’s underground facilities.

For now, Iran barters about 1mn m3/d of gas with Armenian power at 1 m3 per 3kWh. Iran said this week that the volume of the gas-to-power deal would reach 3mn m³/d by late 2018 at the improved rate of 1m3 per 3.2kWh.

On the other hand, the managing director of the National Iranian Gas Company (NIGC) Ali Reza Kameli said August 1 that Iran has signed a deal with the Georgian International Energy Corporation to export 40mn m³ over a four-month period to test the feasibility of sealing a long term gas export agreement.

He added that that the deal becomes operational once Armenia has issued the needed permissions by late 2016.

He added that that the deal becomes operational once Armenia has issued the needed permissions by late 2016.

Georgia’s deputy energy minister Mariam Valishvili told Trend that the ministry has no information on the conclusion of contracts for the import of Iranian gas to the country. Valishvili added that the Georgian government has not concluded the contracts for such gas supply. “Theoretically, private companies can sign a contract like that,” she said.

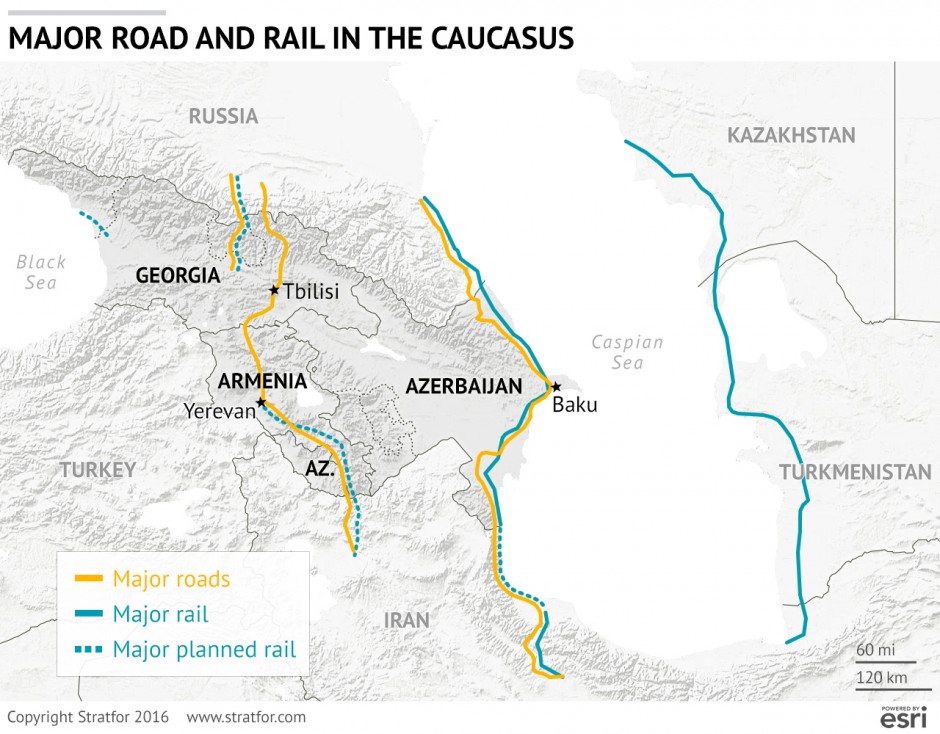

For now, Georgia receives more than 87% of its 2.5bn m3/yr demands from Azerbaijan (1.36bn m3/yr as commercial imports plus 5% of Azerbaijani gas transit to Turkey as fee) and takes 10% of Russian gas deliveries to Armenia as fee.

Iran also announced August 2 that it is willing to store its gas in Azerbaijan’s underground gas facilities. Azerbaijan has two gas storage facilities that can hold 5bn m3, of which a third is idle.

For now, two countries swap about 1mn m3/d of gas, while Iran has a 10% share in Azerbaijan’s Shah Deniz gas field.

Iran’s sole commercial buyer is Turkey. According to official statistics, Iran increased deliveries to Turkey in five months of 2016, while Azerbaijan and Russia cut gas deliveries to this country.

Iran aims to export 68bn m3/yr of gas by 2021 and is preparing to announce a joint tender with Oman for choosing a contractor to build a $1.5bn pipeline project in the Gulf of Oman, aimed to transit 10bn m3/yr of Iranian gas to Oman. Some of that gas could be liquefied as the Oman LNG terminal is not fully used.

Kameli said August 2 that “activities related to the gas pipeline project are being carried out rapidly as the marine survey has been completed and evaluation of the obtained information is being undertaken. After receiving the results of studies, we will decide with the Omani side who will be the contractor for the 200-km undersea pipeline.”

Iran is also preparing to start a restricted amount of gas supply to Baghdad this month at 5-7mn m3/d. This figure is to reach 25mn m3/d, based on agreements, in the coming years.

Iran has two agreements with Iraq to export 50mn m3/d of gas to Baghdad and Basra in total.

Iran also has a 22mn m3/d gas export agreement with Pakistan, projected to become operational in early 2015, but the pipelines are not completed in either country yet.

Iran is also looking for a contractor to resume building the Iran LNG project, which was half complete when it was hit by western sanctions. Gazprom is one of the companies to express an interest in taking part but it said August 2 that Iran hadn’t responded to its request yet.

Tehran has invested $2.5bn in this project which is hoped will produce 10.4mn mt/yr of LNG by late 2018.

Gazprom does not need extra gas but the Russian company most likely would like to suspend the growth of Iran’s gas exports,” said Mikhail Korchemkin, head of East European Gas Analysis. There is a threat of competition facing Iranian LNG projects, not from Russia but other players in the gas market although Iran’s LNG would have one of the world’s lowest feedstock prices.

Iran and Turkmenistan have also expanded their gas deals. Last year, Turkmenistan doubled deliveries to Iran to above 9bn m3/yr. Iran said June 27 that it will import gas worth $30bn from Turkmenistan over the next ten years and export engineering goods and services to Turkmenistan to an equivalent value.

TAP in progress

Turkmen gas is recognized as a potential source for feeding the Southern Gas Corridor (SGC), aimed to deliver 16bn m3/d of Azerbaijani gas to Turkey and EU by 2021. The volume would increase to 25bn m3/yr by 2025 and 31bn m3/yr in early 2030s.

The part from Azerbaijan to west Turkey is being built, while the European part of the SGC, Trans Adriatic Pipelinem (TAP), is being progressed. TAP said July 29 that 14,000 pipes have already been delivered to Greece and Albania for it. This amount accounts for about 30% of all pipes that will be used for the pipeline.

The 870-km TAP will be connected to the Trans Anatolian Pipeline (Tanap) on the Turkish-Greek border, run through Greece, Albania and the Adriatic Sea, before coming ashore in southern Italy. The Initial capacity will be 10bn m3/yr in 2021. The European Bank for Reconstruction and Development (EBRD) confirmed earlier that it started talks to provide direct financing of €500mn and attract €1bn from banks.

The current cost of the SGC from the Shah Deniz 2 reservoir to landfall in southern Italy, is now estimated at around $40bn, comprising $9.3bn for Tanap, $6bn for TAP and $23.8bn for developing SD2 as well as the expansion of the South Caucasus line (SCPX).