Albania and China, a love story or necessity?

Long time relationship between China and Albania since the communism era during the dictatorship of Enver Hoxha.

China Claus is coming to town! For better or for worse, Chinese companies are replacing traditional European investing partners — namely Italy and Turkey — and helping to develop a country in dire need of modernization, particularly if it wants to move from its European Union candidacy status to a full blown member in the foreseeable future.

But, like everything involving China, when the world’s No. 2 economy comes knockin’, they are trying to bring a few hundred Chinese personnel waiting to be let inside. Moreover, the companies investing in strategic assets are often government owned, which should raises eyebrows in the halls of power throughout Europe, particularly in Brussels.

There is concern among some leading Albanian politicians that when China invests, it does so to export its own labor into the foreign market. This is particularly worrisome in the case of Albania that has more than 17.1% unemployment rate, and where jobs are badly needed.

For now, China has become a leading trading partner for Albania, a small, mountainous Balkan state on the Adriatic Sea. Chinese investments are relatively new there, so for companies like Geo-Jade Petroleum, this is a whole new world.

“China is an important economic partner to Albania, but we need to ensure we are getting a fair deal that generates economic growth…and creates more jobs here in Albania, for Albanians,” says Ilir Meta, the country’s former Prime Minister and now Speaker of Parliament since 2013. Meta has been involved in Balkan politics since the implosion of Yugoslavia in the 1990s and remains a popular and influential figure in the country decades later.

The Durres Port in Albania. China is in talks with the government to build an industrial park there. It already owns the country’s largest airport, is rebuilding an ancient Roman Empire road, and acquired rights to an oil field from Canadians.

What is China up to in this small lower-middle income nation of over 3 million including a large diaspora? The second poorest in Europe after Moldova, it has an economy that’s smaller than many Chinese companies.

On June 6, the Albanian government said that it was ready to ink a deal with China State Construction (CSC) to build a 200 million euro, 16-mile stretch of road to neighboring Macedonia. The so-called Arber Road project has been partially built by the Albanians, but parts of it are still a cobbled stoned street that dates back to the Roman Empire, while most of the road is a two lane pothole riddled, slow moving, road that hinders efficient transportation and needs to be turned into a modern highway. The Chinese will pave the way into the 21st Century, creating an important transportation route for Albanian commerce.

In March, China’s Geo-Jade Petroleum, a publicly traded oil company listed in Shanghai, bought controlling rights in two Albanian oil fields then controlled by Canada-based Banker’s Petroleum for a cool $442.3 million. Albania’s Patos-Marinza is the largest onshore oil field in Europe and several international companies have signed exploration contracts with the government, including Royal Dutch Shell in 2012. Those two China deals alone account for nearly 5% of the country’s 2015 nominal GDP.

In April, state-owned asset manager China Everbright and Hong-Kong based Friedman Pacific Asset Management announced they were buying Tirana International Airport in a concession deal that has the Chinese co-owning Albania’s only commercial airport for the next 10 years. The move is consistent with China’s strategy of buying stakes in major transportation hubs along the Mediterranean, including Cosco’s April purchase of Greece’s Piraeus port and Shanghai International’s March 2015 successful bid to operate the new Haifa port in Israel for 25 years.

Within the first four months of 2016, China increased trade to become the second largest trading partner for Albania. In March, it accounted for 7.7% of exports up from 6.3% last year, surpassing old-time partners Greece and Turkey, and next-door neighbors in the Balkans. According to Santander Bank, foreign direct investment in Albania now accounts for 50% of its GDP. China’s newfound love for Albania, therefore, is a vital source of foreign capital.

Like every other developing country, Albania is busy rewriting the rule books in order to make it an attractive place for corporate investors. It’s adopted new tax policies that aim to reduce corruption and administrative difficulties. Bureaucratic procedures to obtain operating licenses have slowed down investment progress. Since 2013, FDI flows to the country have exceeded $1 billion, a trend that should continue, according to the United Nations Conference on Trade and Development.

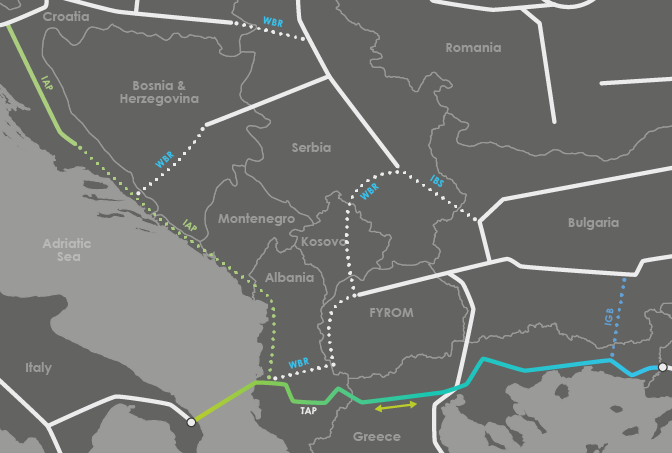

Major investments include the Trans Adriatic Pipeline passing through Albania, putting it on the map of a European Commission energy project known as the Southern Gas Corridor. The pipeline’s biggest integrated oil and gas player from the West is BP, with a 20% stake. Azerbaijan’s Socar shares another 20%, along with natural gas pipelines manufacturer Snam S.p.A of Italy. The Commission is bank-rolling most of this in an effort to diversify fuel supply. Russia accounts for at least 30% of foreign oil and gas into the E.U. Other large projects include the Devoll River Cascade, a hydroelectric power plant being built by Norway’s Statkraft. Its most desirable sectors seeking investment: tourism, agriculture and manufacturing.

Tirana International Airport. A Chinese company won a bid to operate Albania’s largest port for the next 20 years. (Tirana Airport corporate photo. Used by permission.)

“Albania’s agriculture sector is rich and ripe for investment,” says Edmond Panariti, the country’s Agriculture Minister. “We want the E.U. and the U.S. to look at agribusiness, and place as much attention on this as the Chinese. This will help create Albanian jobs and stimulate our economy,” he says via email from his offices in Tirana. This month, China’s government cranked up the volume on its soft power by giving Albanian farmers a 1.3 million euro grant to buy new equipment.

For the investment-hungry countries of southeastern Europe, Chinese investments are a welcome complement to E.U. funds. E.U. integration is the long-term goal, supported by a wide cross-party consensus in Albania. But when it comes to funding, some of these countries perceive Chinese cash as practically the only available way to overcome the following dilemma: access to large E.U. structural funds for candidate countries is not possible until they join the Union, but in order to make progress towards accession, countries need to improve infrastructure and transport links both within their borders and with neighbors, according to a report by the Central European Initiative, an intergovernmental forum based in Italy.

Balkan countries will continue to seek European funding for capex-intensive infrastructure projects of European importance that – so far – are not reliant on China. The Trans Adriatic Pipeline is one of those. As is the so-called “Peace Highway”, which will connect Albania with Serbia and Kosovo. But given the remaining financing gap from the multilateral development banks, the slow process of project approval, and other policy obstacles, China is often able to come in and present itself as an attractive alternative. They come in and offer streamlined approval processes with their companies, and Chinese state-backed financing to put the icing on the cake.

Albania remains one of the least developed countries in Europe. A fifth of its population lives under the national poverty line. Over the years, Albania has made incremental improvements and is now less dependent on foreign aid.

China may be willing to throw caution to the wind. But many Western businesses cite high taxation, unfair competition from the state, and government bureaucracies as their biggest stumbling blocks to investing in Albania. A survey in 2015 had 70% saying taxes were unfavorable for their businesses.

Risk averse Westerners are no match for swashbuckling Chinese, who are flush with cash and increasingly allowed to take capital out of China. Albania has become attractive to the Chinese, a country that’s starting to show its expertise in inking deals in the less developed world.

Albania is strategically positioned at a crossroad between east and west, with the major port of Durres linked to the Balkan hinterlands and the rest of Europe by rail. The economy is showing signs of improvement. Albania grew 2.3% last year. In Europe, that’s better than most. The country’s credit rating is still subprime, but it was upgraded in February by Standard & Poor’s to B+.

Albania’s former Prime Minister and now Speaker of Parliament, Ilir Meta, says Albania is “an excellent opportunity” for foreign investors, not just the Chinese newcomers who can’t seem to get enough of it.

For Parliamentary Speaker Meta, these are necessary growing pains to get the Balkans looking more like the Baltics, ex-Soviet economies that have escaped the gravitational pull of the planned economy black hole. Albania’s GDP per capita was $4,659 in 2013, making it lower than China’s. Albania GDP per capita has risen three-fold over the last decade, but of the six Balkan states that’s second to the last placed finisher: Kosovo.

On the bright side, there’s plenty of room for improvement. And they have examples from neighbor states like Bulgaria and Montenegro to show them, the Chinese, the Europeans and the Americans, that they might get their too.

Powered by international and U.S. development aid, Chinese financial muscle – and with the gates of E.U. opening in front of it – Albania’s future is better than it used to be. “We are in the final phase of endorsing in Parliament the judicial reform laws with quality, integrity and legitimacy that will change the public perception about how we fight against corruption and organized crime, and are creating a better, safer business climate for investors,” Meta says in an email interview from Albania. “I think it brings us closer to truly starting negotiations for EU accession. We play a big role in the region. We just need to do more to raise the standard of living and that means developing sound economic policies that create jobs,” he says.

Map of the Trans-Adriatic Pipeline. Energy projects are of course a favorite of foreign investors. TAP’s biggest Western investor is BP. (Image from the Trans Adriatic Pipeline website)