Summary

Bankers is extracting crude from continental Europe’s largest onshore oilfield; Patos-Marinza in Albania.

Growing production with the move from old, reactivated, vertical wells to efficient, horizontal wells.

Thriving in the recent crude price slump due to improving efficiencies, netbacks, and market price of crude extracted.

Target price of $4.50 based on DCF & Comps.

Analyst: Keegan Taberner

Business Summary

Bankers Petroleum (OTCPK:BNKJF) is a heavy oil producer based in Calgary, AB, with all extraction operations in south-western Albania. Bankers began exploration and operation in Albania in 2004 to revive the then defunct Patos-Marinza oilfield. The Patos-Marinza field is the largest onshore oil field in continental Europe. Bankers is Albania’s largest oil producer and foreign investor.

What do they do?

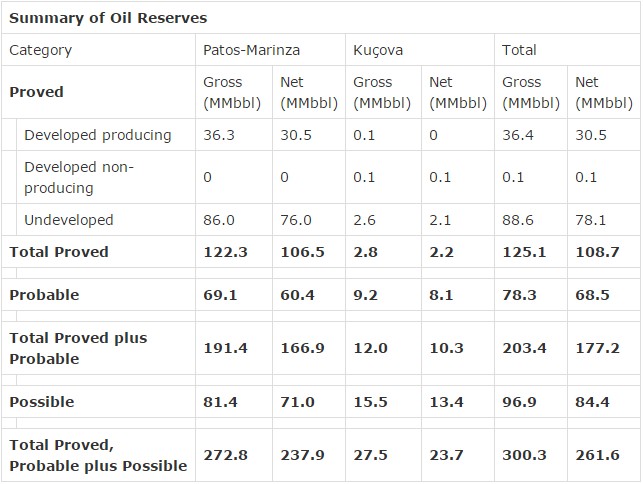

Bankers Petroleum controls two oilfields and an oil and gas exploration holding in Albania. Using a combination of pre-existing, low-cost, vertical wells and new horizontal wells, Bankers has been able to effectively reactivate continental Europe’s largest oilfield; the once defunct Patos-Marinza oilfield (191 million barrels proven plus probable).

Why does the opportunity exist?

Bankers Petroleum has been a seemingly undervalued company for a number of years. The market discredited the young and risky company after an inability to meet overenthusiastic early predictions of 20,000 barrels of oil per day in 2011 due to liner issues on a number of old Albpetrol wells it restarted. Since this hiccup, Bankers has had large capital expenditures and has seen significant increases in production growth. Additionally, the oil and gas market has seen a recent jump in volatility, a significant drop in Brent crude oil prices, and oil and gas stock prices (including Bankers Petroleum) have plummeted. With an expected rise in Brent crude prices during coming months, today represents an extraordinary time to invest in an undervalued stock in an undervalued market.

What’s changed?

Bankers is growing their production significantly with the move from vertical wells to horizontal wells. The new wells are much more efficient, and are able to achieve higher yields than the old, reactivated, Albpetrol wells. Bankers is also currently exploring the option of hydraulic fracturing through water and polymer injection to further improve recovery rates.

As the company becomes more efficient, netback per barrel (revenues from oil sales, less all costs associated with getting the oil to market) is also increasing significantly.

Continued increases in efficiency will allow Bankers Petroleum to survive during periods of extremely volatile and low Brent prices; and flourish in the coming months as Brent prices rise to an estimated $70 per barrel (as estimated by Bankers Petroleum in 2015 capital budget).

Valuation Summary

Our $4.50 target price for Bankers Petroleum is based on our DCF (discounted cash flow) valuation of $3.98, which uses historical trends, and a $70 per barrel Brent crude price going forwards. These cash flows are then discounted back to present day using a calculated WACC of 10.85%; this is similar to the oil and gas industry standard discount rate of 10%.

In addition to the DCF valuation, we also used a comparable valuation. In the comparable valuation, we compared Bankers with four oil and gas companies with similar market capitalization using three multiples: price to earnings ratio, enterprise value to proven plus probable reserves, and enterprise value to barrels of oil equivalent per day. We found that Bankers was being valued at approximately half of the mean. Were Bankers to trade at the level of its peers, it would imply a $5.50 valuation.

Our target price of $4.50 is the mean of these two valuations ($4.74) rounded down.

Business Description

Bankers Petroleum is a Calgary, Alberta, based oil production company with all extraction operations taking place in south-western Albania.

In Albania, Bankers operates and has the rights to develop the Patos-Marinza heavy oilfield under a contract established in 2004 from Albpetrol: Albania’s state oil company. The contract initially awarded exploration rights, then control of part of the oilfield, and finally, control of the entire oilfield in 2011. The Patos-Marinza oilfield is the largest onshore oilfield in continental Europe, holding approximately 5.1 billion barrels of oil initially in place, and 191 million barrels proven plus probable.

Additionally, through the indirect ownership of all common shares of Sherwood International Petroleum, Bankers holds a 100% interest in the Kuçova oilfield located in Albania, providing it with the right to explore and redevelop the area. Bankers initially acquired 50% of Sherwood’s shares in January 2008, and after an evaluation of the oilfield, acquired the remaining 50%. The Kuçova oilfield has approximately 297 million barrels of oil initially in place and 12 million barrels proven plus probable.

In December 2009, Bankers agreed to a contract with the National Agency of Natural Resources regarding future exploration and development of a 740 square kilometer area located directly west of the Patos-Marinza oilfield known as Block “F”. This area omits three gas fields currently operated by Albpetrol within the boundary of Block “F”.

Bankers Petroleum has significant control over Albania’s oil and gas sector. The company is Albania’s largest oil and gas company, and largest foreign investor. At the end of 2013, Bankers employed 522 people in Albania.

Industry Overview

Albania’s energy industry is relatively small when compared against giants such as Russia, Saudi Arabia, or the United States, but Bankers control of Albania’s market is a highly strategic move that allows Bankers to command lower prices for consumables, and influence infrastructure development in the nation.

According to the U.S. Energy Information Administration, in 2013, Albanian crude production was 17.01 million barrels, and Bankers produced 6.63 million barrels of that total. This represents 39% of the total Albanian crude production; a significant market share that has only been bolstered by the acquisition of Sherwood International Petroleum, and an attempted privatization of Albpetrol by Bankers. This behaviour shows that Bankers is certainly interested in becoming a consolidating force and growing its share of the Albanian crude market.

As Albania is not a member of the European Union, the country sets its own environment and commodity regulations. Currently, regulation is remarkably lenient to encourage foreign investment. However, be advised that this leniency is at risk of Albania joining the European Union and adopting much stricter regulation.

Business History

In June 2004, Bankers acquired an interest in the Patos-Marinza heavy oilfield in Albania.

The Patos-Marinza License and Petroleum Agreements provided 24 months to evaluate the Patos-Marinza field and propose a plan of development to Albpetrol and the Albanian National Agency of Natural Resources.

Bankers completed the evaluation phase of the field in December 2005, and submitted a proposal of development. Albpetrol and the National Agency of Natural Resources approved the proposal of development in March 2006.

These approvals allowed Bankers to take over the existing wells in the field within the development area and sell oil for a period of 25 years with options to extend for further five-year increments, subject to approvals.

Additional proposals were submitted in March 2008, and December 2008 to provide supplementary detail for the infill vertical and horizontal drilling, water and polymer injection, and thermal (steam) programs that were planned. The amendments were approved in December, 2008.

During 2008, Bankers acquired a 100% interest in Sherwood International Petroleum, which holds the rights to the Kuçova oilfield in Albania that has approximately 297 million barrels oil initially in place, and 12 million proven plus probable. Bankers now operates the Kuçova oilfield. The Kuçova Petroleum Agreement became operational in September 2007 and has a 25-year development term after the evaluation phase, with options to extend for further five-year increments.

During 2010, Bankers completed negotiation of the Block “F” Production Sharing Agreement. Block “F” is located nearby the Patos-Marinza oilfield, and covers an area of approximately 740 square kilometers. The area contains several areas defined by natural structural rock anomalies prospective for oil and natural gas.

In March, 2011, Bankers reached an agreement with Albpetrol to take control of all remaining Albpetrol wells in the area that is already controlled, and expand the contract area to include all of the Patos-Marinza oilfield.

In September, 2012, Bankers announced its participation in a proposition for the privatization of Albpetrol. Bankers’ bid was a combination of cash and future programs funding social programs and the remediation of inherited environmental issues.

While the bid was ultimately unsuccessful, the winning bid enhances Bankers oilfields’ valuation and demonstrates Bankers commitment to expand its business activities in Albania.

Patos-Marinza Oilfield History

The Patos-Marinza oilfield is the largest on-shore oil field in Europe, the proven plus probable reserves are approximately 191 million barrels. The oilfield was discovered in 1928, and production by state-run Albpetrol began shortly after, in 1930. Albpetrol was in control of the Patos-Marinza oilfield for the entire period spanning 1928 to 2004, before Bankers took control.

However, the field has not been producing to capacity the entire time. Initially, World War II led to a decline in output. Consequently, the 1948 production was just 1.37 million barrels per year. Maximum production was achieved in 1974 with 17.38 million barrels per year. Production gradually began to decline as instability plagued the country. In 1989, total annual production was 7.9 million barrels per year and in March 1994 it was just 3.75 million.

In 1994, Anglo-Albanian Petroleum Ltd. a joint venture of Albpetrol and Premier Oil Plc. was formed as a new company and operated a small portion of the field with just 20 wells until 2004

Capital Structure

Receivables

At December 31, 2014, total receivables consisted of $81 million. $48 million from Albanian petroleum refineries, $30 million for Albanian VAT, and $3 million for miscellaneous in Canada.

Prepaid Expenses

Of the total deposits and prepaid expenses of $45 million, $35 million was paid to the Albanian court as deposits for procedure purposes on a number of legal cases. The recoverability of these amounts is dependent on the outcome of these cases. As of December 31, 2013, these amounts were considered recoverable. The company expects to collect the full amount of deposits paid to the Albanian court and has classified the full amount as current.

Credit Facilities

Bankers has credit facilities totaling $223 million, of which $99 million was being used at fiscal year 2014 end. The facilities consist of a $20 million operating loan from Raiffeisen Bank, a $3 million environmental term loan, and $200 million in revolving loans, equally funded by the International Finance Corporation and European Bank for Reconstruction and Development.

Bankers approach to managing liquidity is to ensure a balance between capital expenditure requirements and funds generated from operations, available credit facilities and working capital.

Capital Expenditures

Bankers’ capital expenditure budget of $313 million for 2014 was funded by a mix of cash flows, existing credit lines and existing cash. The budget focused on continuing to increase production in Patos-Marinza, with exploration of profitability of Kuçova, and mapping and testing of Block “F” to determine if reserves of oil or natural gas exist.

Major capital outlays included the continued reactivation program of old wells, the acquisition of 6 drilling platforms, and the conversion of 14 existing wells for water and polymer injection.

Bankers typical horizontal well costs approximately $1.2 million (down from $1.3 million in 2012) and produces about 150,000 barrels. With a 50% drop in initial production over the following 12-18 months the company recovers its capital cost of a well on average in about 10 months during which some 28,000 barrels of oil are produced. This leaves the well with an additional 128,000 barrels of reserves to be produced over another ten years with annual declines of 15%.

Additional expenditures include 3D seismic graphing of rock formations in Block “F” and horizontal test wells in Kuçova.

Expanding Margins

As Bankers production continues to grow rapidly, management is seeking methods to reduce costs and increase netback on a low price Brent. This will be achieved through a number of controllable costs, which include diluent costs, in-field transportation costs, cost of energy to operate wells, and well servicing costs.

Diluent costs

Bankers uses diluent extensively throughout the Albanian operations. Beyond the most common use, diluting the thick crude before being brought to market, it is also used to help break out water content at smaller and older well operations, as well as at Bankers central treating facility, and is used to flush out wells clogged with sand and to reduce the viscosity of well contents to lower pump labouring.

The Patos-Marinza oilfield has traditionally produced very thick, viscous oil from the older vertical wells. Before this oil can be brought to market, it must be diluted to become salable. Unfortunately for Bankers, the process of dilution is expensive, and accounted for $7.12 per barrel of oil in 2013.

Bankers is currently making improvements regarding the consumption of diluent, and the cost of diluent. Bankers is experimenting with the ratio of produced oil to diluent for flushing of wells; hoping to find a higher ratio to reduce the amount of diluent required per barrel. Similarly, Bankers is drilling in new zones with horizontal wells that are producing oil with lower viscosity. This is vital to a reduction in quantity of diluent consumed. Finally, Bankers has negotiated a contract with a new chemical supplier at a reduced price.

Future initiatives include optimizing treating chemicals to reduce water content, and continued exploration for lower viscosity oil through the expanded horizontal well drilling program.

Energy Consumption

Diesel generators power the majority of Bankers operations due to remote locations, and lack of local power infrastructure. In the past, all of Bankers single wells and wells on a pad were powered by diesel generators. Energy accounted for $3.13 per barrel in 2013; a significant improvement in the consumption of energy, or an improvement in the cost of the energy will generate in significant savings for Bankers.

Energy costs vary widely depending on the power type for the wells. Single diesel wells currently cost approximately $220 a day to operate, electric wells cost $70, and natural gas wells cost $10. A pilot project has been started with the intention of testing the viability of natural gas and electric wells. The cost to convert from diesel to electric is $15K, and to natural gas costs $20K. Current well drives consist of 61% diesel, 32% natural gas, and 7% electric.

Current pad setups include many diesel generators, with many fuel tanks, and many heaters to keep the fuel liquid in low temperatures. This set-up is not very efficient, and Bankers is improving by consolidating fuel tanks and heaters, and trapping vented combustible gas produced from heating the fuel.

Future initiatives are focused on the expansion of current improvements. Bankers hopes to increase the number of natural gas, and electric wells. In addition, Bankers hopes to have their operational field electrified to further reduce costs.

Finally, Bankers is exploring the option of capturing gas from produced oil to power the field. This gas is expected to power 70 wells at current output.

Well Servicing

Servicing of Bankers large inventory of numerous types of wells is a costly operation. Servicing accounted for $4.11 per barrel in 2013. In the past, Bankers pumps were a “one size fits all” design that was a high efficiency, tight running pump that coped poorly with the heavy Albanian crude. Generic repair programs were implemented, and production lost as a result was minimal.

Currently, Bankers is running a low efficiency pump that handles the thick crude much better. Future initiatives include fitting a specialized pump to each well to further improve longevity and efficiency. Additionally, Bankers is developing optimizing the metallurgy of its rods and tubing as well as implementing a chemical coating program to reduce corrosion.

In-Field Transportation

As Bankers continues to scale from a small operation with a handful of single wells, to a large operation with hundreds of wells and a half-a-dozen pads, transportation of oil, water, diesel and other commodities within the field is an important infrastructure to keep scaled and efficient. In-field transportation accounted for $2.41 per barrel in 2013.

Previously, single wells required trucking of oil, water, diesel and emulsion to and from individual wells to treating facilities.

Now, Bankers is focusing on pad site optimization. A portion of the field has been tied in with flow lines (small pipelines). Focus is currently on development surrounding high volume routes near major treating facilities and on setting up a header system as multi-well pads to allow easy connection to the flow line system. Finally, despite a desire to move away from trucking, it still exists in some extent. The current goal is to optimize in-field trucking system within the field to reduce number of truck movements.

Future initiatives consist of a single goal: significant expansion of the flow line system between well pads and treating facilities.

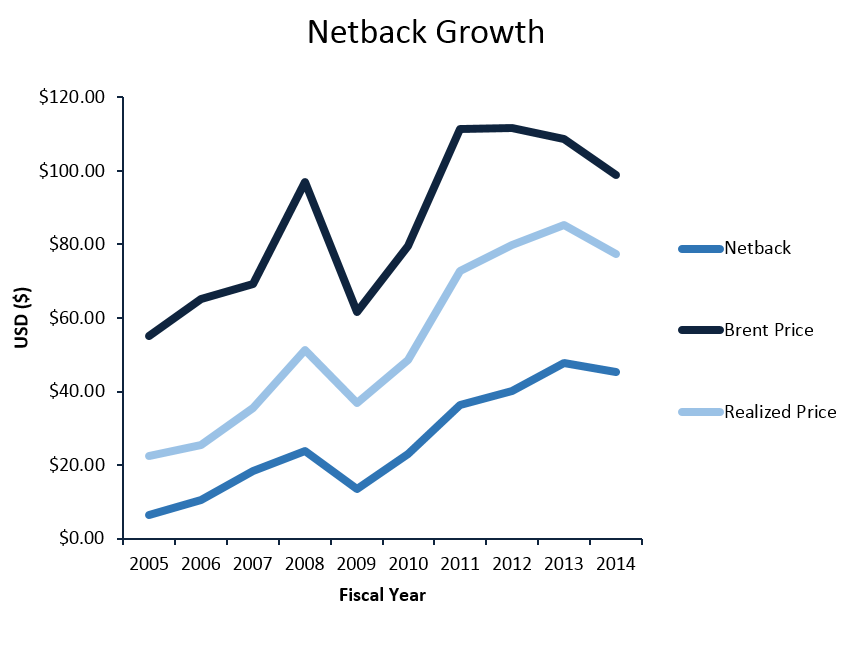

During the period from 2005 – 2014 netback increased from $6.44, to $45.36. Over the same period, barrels of oil per day output increased from 1,668 to 20,630 (as is shown below). However, we can see that these increases have a positive correlation with average Brent prices and average realized Brent prices.

During this period we see average Brent prices rose from $55.19, to $98.95 and average realized price rises from $22.52, to $77.26. This suggests that Bankers has spent much of its capital expenditures improving the quality of oil it brings to market, which increases the average realized price. It also suggests that Bankers has not done much to significantly reduce costs, as the rise in netback is mostly associated with the rise in realized Brent price.

Going forwards we can expect to see a large effort for reductions in cost of bringing the oil to market as the company contends with low Brent prices to maintain a reasonable netback.

Revenue Model

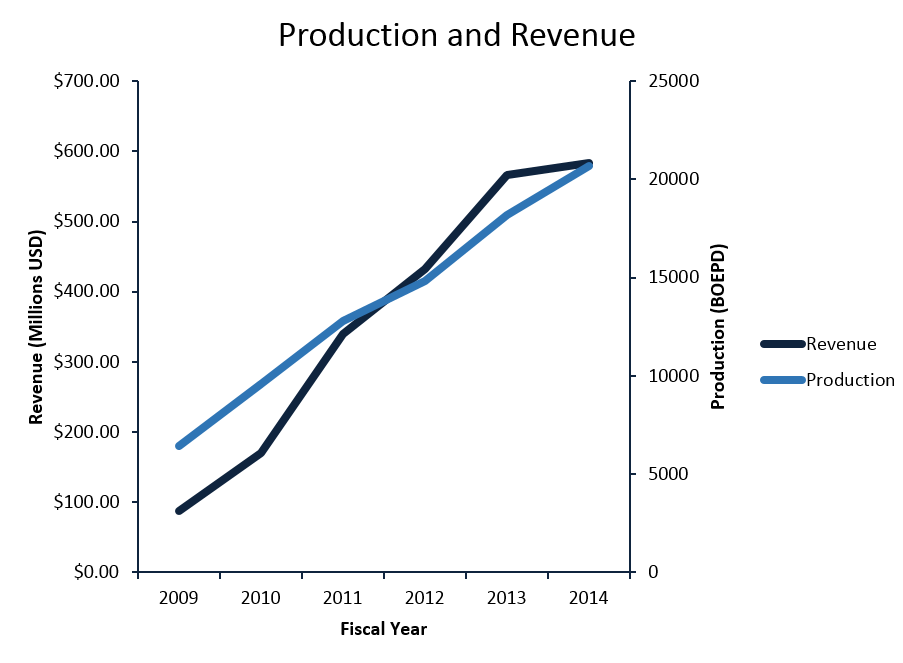

Bankers revenue is directly associated with Brent crude prices, production levels, and costs. Bankers significantly increased its oil revenue and net income in 2013. This was primarily achieved due to continued success in the horizontal drilling program. Note this was less significant in 2014 to due lower Brent prices.

In 2014 revenue from oil and gas sales was $583 million which was an increase of 3% on 2013. In 2013, revenue from oil and gas sales increased by 31% to $566 million, up from $432 million in 2012.

Part of this revenue increase in 2013 can be attributed to an increase in the average realized price of Bankers’ oil, which climbed to 79% of average Brent, up from 71% of average Brent in 2012 because of Bankers’ new focus on higher quality, lower viscosity oil. In addition, Banker’s has continued to increase production, with 2014 production of 20,690 boe/day, compared to 18,169 boe/day, and 15,020 boe/day in 2013 and 2012, respectively. This represents production growth of over 20% year over year.

During Bankers early years, focus was on increasing growth and quality of oil being extracted. Going forwards, we expect to see a continued focus on increasing growth and quality, with an additional focus on decreasing costs due to a lower Brent price.

Brent Crude Pricing

Bankers preference for Brent crude stems from the fact that it is a better indicator of global oil prices. Brent crude draws its oil from more than a dozen oil fields located in the North Sea. Although most Brent is destined for European markets, it is used as a price benchmark for other grades.

Bankers has forecasted Brent oil prices to average $70 per barrel in 2015. We see this as a valid price and have incorporated it into our predictions.

Bankers is currently commanding an average price per barrel that represents approximately 78% of Brent oil price, due to the heavy nature of the oil. During 2014 Bankers achieved a netback of $45.36, with costs of $31.90 on a $98.95 Brent. This shows that even at $70 per barrel, netback will be $22.70: a positive net income.

Royalty Structure

The terms of the Petroleum Agreement include a 1% gross overriding royalty payable to Albpetrol which increases to 3% (based on an incremental sliding scale) after payout of funds by Bankers.

In addition, Bankers pays a royalty to Albpetrol for the share of pre-existing or base production from the Albpetrol wells taken over by Bankers. This royalty is calculated on a per well basis using 70% of the average production for the preceding six months declining at 15% per year. For the original 28 oil wells taken-over in July 2004, a fixed pre-existing production rate was applied and is declined at 10% per year; 20 of the 28 wells have no pre-existing production liability as they were newly drilled wells by the previous operator, Anglo-Albanian Petroleum.

In 2008, a new royalty tax of 10% was implemented on sales volumes payable directly to the Government of Albania. The tax is applied to gross sales amounts net of pre-existing production royalties in a fashion similar to the share of production royalty payable to Albpetrol.

Overall royalties for the 2013 fiscal year represented 17% of oil revenue, down from 18% the year before; Bankers expects this to continue decreasing to 14% over the next 5 years as pre-existing well production drops.

NI51-101 Summary

Patos-Marinza

The proven and probable undeveloped reserves are being put on stream by a program of 203 attempted vertical well reactivations, with an average success rate of 65%, resulting in 132 successful reactivations.

The success rate for any given reactivation attempt is uncertain, therefore has been treated probabilistically. Historically, the average success rate is estimated at 65%, which is carried forward in future well reactivation development forecasts.

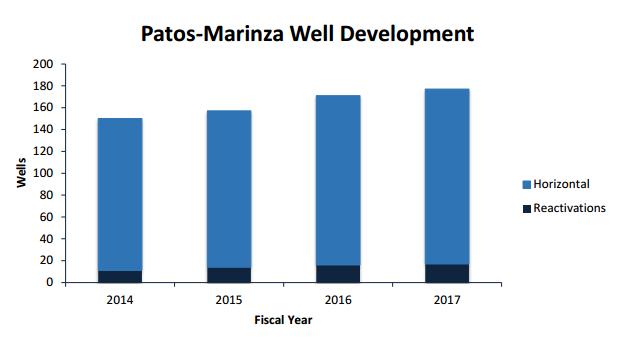

In addition to vertical reactivations, the program consists of 995 horizontal wells. For the first four years, this program includes successful vertical well reactivations numbering 11 in 2014, 14 in 2015, 16 in 2016 and 17 in 2017. The horizontal well program is comprised of 139 wells in 2014, 143 wells in 2015, 155 wells in 2016 and 160 wells in 2017 (see graph below).

The development programs are scheduled to maximize and maintain the capacity of production facilities for as long as is feasible.

Kuçova

The Kuçova oilfield was discovered in 1928 and was developed with the drilling of 1,722 wells in 5 major crude oil pools (Kozare, Gege, Ferme, Arreza, and Kucova Sector 1). As of the end of fiscal year 2013, approximately 357 wells were producing on primary production at approximately 170 barrels of oil per day from the four main pools that Sherwood is planning development on (Kozare, Gege, Ferme, and Arreza).

The proven plus probable reserves are currently estimated at 12 million barrels of oil. The future redevelopment forecast for the field involves the implementation of secondary recovery schemes (water flooding) to improve recovery. All future reserves recovery assigned to Bankers, proven undeveloped and probable, is based upon the successful implementation of the secondary recovery projects. Production forecasts are based on performance of similar type reservoirs under secondary recovery processes located in Western Canada. Initial fieldwork was commenced in 2011 and production was commenced in 2012.

Investment Risk

Operations in Albania

Currently, nearly all activities are conducted in, and all assets are located in south-western Albania. This represents some risk, as Albania transitioned from a communist regime to a modern economy in 1992. While the change has brought economic stability to the country, significant challenges still exist.

Nationalization is often a major risk facing investors in many emerging markets. However, in over two decades since breaking the communist regime it appears the nationalization risk in Albania is low. In fact, the previously state-owned Albpetrol was recently privatized in a sale that Bankers placed a bid on. As Albania’s modern economy continues to develop, we can expect any nationalization risk to continue to drop.

Nevertheless, there is no guarantee that Albania’s government won’t implement different policies in regards to development and ownership of petroleum resources by foreign companies. Any changes could negatively affect both the ability to undertake exploration and development of future properties, and the ability to continue to extract resources from current properties.

The government of Albania encourages direct financial investment to aid the country’s economic development. However, it provides little incentive to encourage this much-needed investment, and Albania’s energy and transportation infrastructure is continuing to deteriorate as a result.

Bankers Petroleum is Albania’s largest oil producer and foreign investor. Albania has treated resource extraction companies well over the past two decades, especially Bankers, and we expect this trend to continue as Albania continues to develop and as Bankers continues to grow.

Volatility in Oil Prices

As with any petroleum company, profitability is directly linked to the price and demand for oil. The sales of oil will be affected by numerous factors beyond Bankers’ control, including general demand for crude oil by the refineries in the Mediterranean region. In addition, prices for petroleum products are affected by numerous factors beyond control including international economic and political conditions, weather, levels of supply and demand, pipeline capacity, and currency exchange rates.

Bankers has confidently predicted a $70 per barrel Brent for 2015 and we feel this is a valid prediction. However, significant movements in the price of oil could render any of the exploration and production activities unprofitable. Costs were last reported at $32.77 per barrel in Q3; therefore, the company will continue to have a positive net profit for any price Brent higher than $32.77.

However, this does not represent a positive cash flow, as the company has and will continue to have significant capital expenditures. Capital expenditures were $234 million for 2013, which resulted in a negative change in cash of $9.1 million.

If we see a lower Brent price than predicted, Bankers will see significant losses and share price will fall, which could render this valuation invalid.

Environmental Risk

Environmental laws and regulations affect all of the operations in located in Albania. These laws and regulations set standards regarding certain aspects of health and environmental quality, and establish obligations to remediate current and former facilities.

Bankers could face significant penalties for discharges into the environment or environmental damage caused by non-compliance. These penalties could have adverse effects on the financial condition of the company.

Additionally, Albania’s aspiration to join the EU may result in the adoption and enforcement of tighter environmental laws and regulations. In October 2012, the European Commission recommended that Albania be granted EU candidate status, subject to key changes in political stability, economic stability, integration and the ability to assume the obligations of a member state.

Loss of right to Oilfields

In 2011, Albania voided an agreement for exploring oil and gas with Sky Petroleum. The license affected would have given the Texas company exclusive rights to three exploration blocks totaling approximately 5,000 square km. In May 2013, the International Court of Arbitration rejected all claims by Sky Petroleum and ordered them to pay Albania 383,000 Euros to cover expenses.

Bankers right to extract oil from the Patos-Marinza field is administered by the Patos-Marinza Licence Agreement, the right to redevelop the Kuçova heavy oilfield is administered by the Kuçova Petroleum Agreement, and the right to explore Block “F” is administered by the Block “F” exploration contract.

If Bankers is unable to finance capital expenditures and it is unable to obtain the agreement to a reduction in such expenditures in its annual plan, Bankers could be forced to relinquish some or all of its oilfield areas.

Should a dispute arise, there is no assurance that it would be resolved in a manner acceptable to Bankers, and if a decision were made that would reduce the rate at which Bankers is able to develop the field or increase production, or that would require a reduction in production from the field, it will have adverse effects on the earning potential of Bankers.

Investment Summary

Bankers Petroleum represents a lucrative opportunity for investors to participate in the turnaround of a once defunct oilfield by a small, Alberta based underdog in the petroleum business.

Production has improved significantly over the past year, and is set to increase going forward with new wells about to go on line. This will be coupled with a rise in netback due to significant reductions in cost being currently being put on line. As these changes continue to take place and as Brent begins to rise in the coming months, the market is likely to take notice of the company it brushed off. Bankers is thriving, and continues to meet or exceed expectations.

Keen investors will long the stock now, as shares are undervalued. Bankers is easily worth $4.50 per share as per our valuations.

Discounted Cash Flow Analysis

WACC

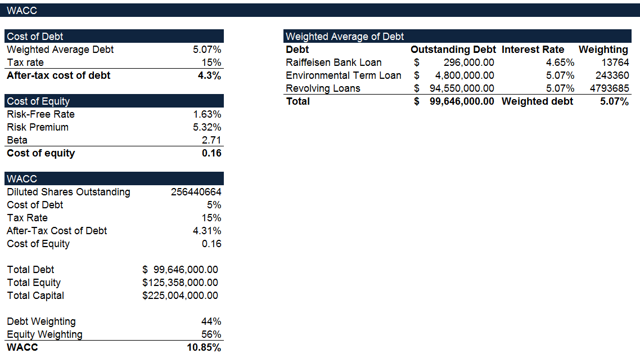

For the DCF analysis we calculated the weighted average cost of capital, rather than using the oil and gas industry standard of 10%.

The cost of debt was found by taking a weighted average of the yield to maturity rate on current debt. We then calculated the after-tax cost of debt using the historical tax rates which Bankers has experienced. This resulted in an after-tax cost of debt of 4.3%.

The cost of equity was found next. The risk free rate is the yield on a five year United States Treasury bond (1.63%). Next, the risk premium was found to be5.32% on Aswath Damodaran’s website. Finally, the Beta of Bankers was taken directly from Google finance (2.71). This results in a cost of equity of (.16).

Finally the WACC was calculated using the fully diluted number of shares (256,440,664), and was found to be 10.85%, which is strikingly similar to the industry standard of 10%.

Figure 1: WACC Calculation from DCF model

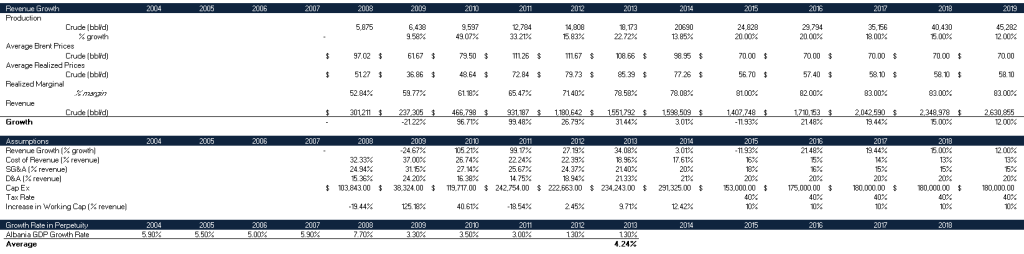

DCF Assumptions

The most vital part of any discounted cash flow valuation is the integrity of the assumptions of growth and costs. We believe these assumptions to be as reasonable as possible given current price volatility of Brent, the previous performance of the company, the age of the company, and any indications of future growth and costs as given by the company.

Revenue

Revenue for Bankers Petroleum is based on two variables; the price of Brent, and the quantity of Brent that Bankers can extract and sell. Going forwards, Bankers has estimated the price of Brent to average $70 per barrel; we have used this estimate for 2015 through to perpetuity.

Bankers Petroleum has provided no future predictions for production, so we have estimated production based on number of vertical and horizontal wells being drilled and put on line and aging of wells. Production growth is expected to peak over 2015 and 2016, and growth will slow thereafter as all reserves are employed using the most efficient methods. This will allow Bankers growth to follow a natural bell curve shape due increases in efficiency and then finally an increased marginal cost and effort required to extract oil as the wells and reserves start to reach capacity.

Our next prediction is average realized prices. Bankers wells have traditionally produced very heavy, viscous oil that traded at a reduced cost from true Brent prices. As Bankers continues to transition more of their wells to horizontal wells, they expect viscosity to drop and quality to rise. From this, we can infer a gradual climb to higher quality oil. This is slowed from historical growth in marginal realized prices, as this reflects a strengthened effort to reduce costs rather than rapidly increase oil quality.

Costs

Our assumptions regarding cost are mainly derived from previous performance and a stated effort to further reduce costs rather than focusing on oil quality.

Cost of revenue (as a percent of revenue) since Bankers inception has been decreasing at a decreasing rate due to increasing economies of scale, and we can expect this continue over the years forecasted. In perpetuity this will reach a constant value as maximum economies of scale are realized.

Selling, general and administrative expenses have been relatively consistent as a percent of revenue for Bankers, with only a slight decline over the past four years. We can expect this trend to continue as Bankers growth continues; as all systems, offices, staff, and other miscellaneous items are already in place and will require little upgrading as oil production is increased.

Depreciation and amortization as a percent of revenue has been relatively consistent over the life of the company, and we expect this trend to continue as old equipment is phased out. There is no suggestion that this will change.

Capital expenditure as a percent of revenue is in slow decline as reserves begin to reach full capacity with the maximum number of wells active. The 2015 budget shows a relatively small $153 million dollar capital expenditure commitment, which reflects the recent drop in oil prices. However, Bankers still expects oil production to stay relatively close to 2014 levels, as new wells are put online and hydraulic fracturing programs are put online.

Next, we expect taxes to stay constant at previous rates given that Albania remains excluded from the European Union.

Finally, we expect the increase in working capital as a percent of revenue to drop slightly as production climbs as it has consistently been over the past few years.

Growth Rate in Perpetuity

We expect the company to grow at the rate of GDP growth into perpetuity. We understand that this is unreasonable after a certain number of years given the nature of oil reserves depleting over time, but this estimate is valid for upwards of twenty years given Bankers’ estimate of a 27 year proven plus probable reserve life. The average GDP growth of Albania for the 10 years from 2004 through 2013 is 4.24%.

Conclusion

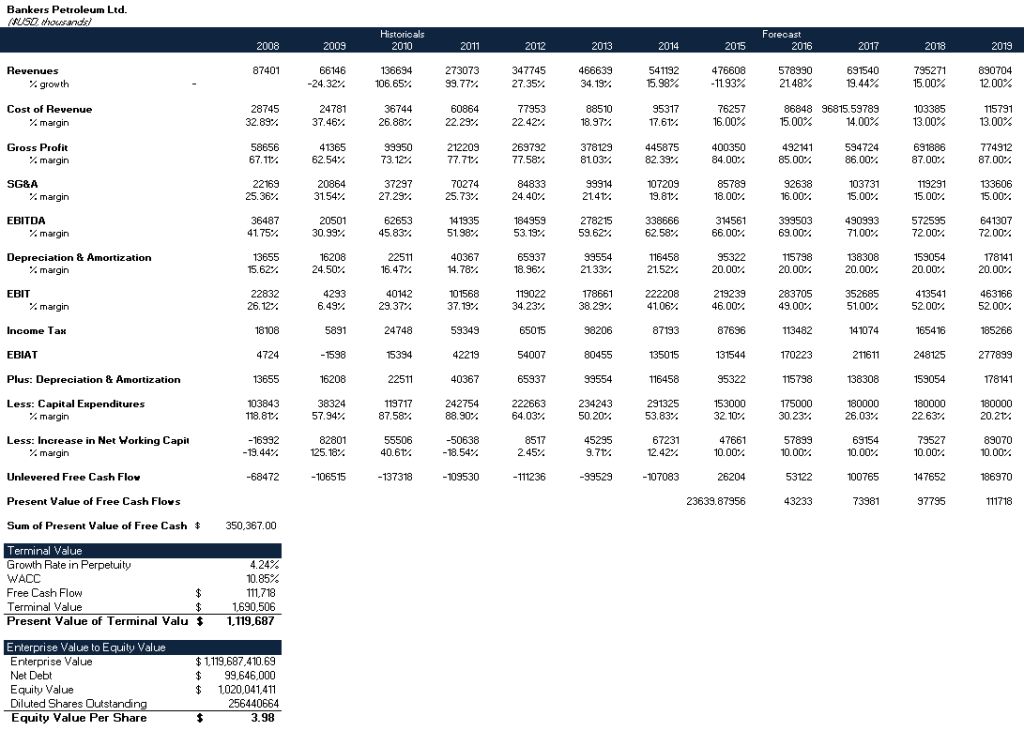

Using the above assumptions, our DCF returned a valuation of $3.98. We feel this forecast is conservative and takes current market volatility properly into consideration. See the figures below for the full DCF model.

Figure 2: Assumption table from DCF model

Figure 3: DCF Model

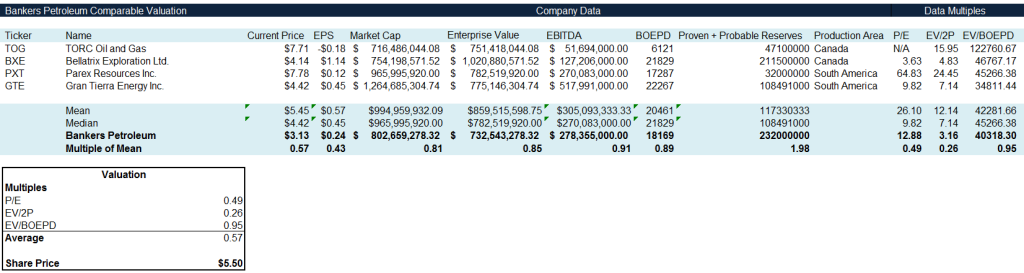

Comparable Analysis

Comparing Bankers Petroleum against four similar companies using three metrics results in a $5.50 dollar valuation. The companies selected were TORC Oil and Gas, Bellatrix Exploration Ltd., Parex Resources Inc., and Gran Tierra Energy Inc. These companies were compared against Bankers using the price to earnings ratio, enterprise value to proven plus probable reserves, and enterprise value to barrels of oil equivalent per day. These metrics were selected due to their commonplace use in oil and gas valuations.

Comparable Companies

Bankers Petroleum produces 39% of Albania’s petroleum, the remainder is produced by a handful of publicly traded exploration firms and a handful private firms. This leaves no comparably sized oil and gas production companies in Albania to compare valuations with. Therefore, publicly traded companies had to be found around the world to compare against.

TORC Oil and Gas

TORC Oil & Gas Ltd. produces crude oil and natural gas in Western Canada. The company was founded in 2010 and is growing production and reserves rapidly. The company was selected due to a similar market capitalization and growth that mimics Bankers in the early years. The reserves reflect the size of Bankers’ during the same period of growth.

Bellatrix Exploration Ltd.

Bellatrix Exploration Ltd. is engaged in the production of oil and natural gas reserves in Canada. It focuses on developing light oil and liquids-rich natural gas on its two development properties. The company was founded in 2000. Bellatrix was selected based on a similar market capitalization, similar daily production, and similar reserve sizes.

Parex Resources Inc.

Parex Resources Inc. is engaged in the production of oil and natural gas in South America and the Caribbean region. It holds interests in onshore exploration and production blocks. Parex Resources Inc. was incorporated in 2009. The company was selected due to a similar market capitalization, similar political environment, and similar daily production.

Gran Tierra Energy Inc.

Gran Tierra Energy Inc., an independent energy company, is engaged in the production of oil and gas properties in Colombia, Peru, and Brazil. The company has 17 exploration and production contracts in Colombia, 5 exploration licenses in Peru, and 7 exploration blocks in Brazil. The company was incorporated in 2003. The company was selected due to a similar market capitalization, similar political environment, and similar daily production.

Figure 4: Comparables Valuation

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

In the last period, by a rapid glimpse seems that we are in a multiplication of initiatives gas pipeline that advance with chaotic and indefinite roadmap interesting directly the South East Europe (SEE). Than without losing here with reporting, about the long list of the initiate, what is evident for sure is that the SEE is passing in the stage of the most interest region regard the growth of the gas pipeline.

In the last period, by a rapid glimpse seems that we are in a multiplication of initiatives gas pipeline that advance with chaotic and indefinite roadmap interesting directly the South East Europe (SEE). Than without losing here with reporting, about the long list of the initiate, what is evident for sure is that the SEE is passing in the stage of the most interest region regard the growth of the gas pipeline.