Game of Pipelines: Bulgaria and Russia’s Energy Diplomacy

Over the past several decades Bulgaria has been attempting to establish itself as the center of the natural gas route in the Balkans, but so far it has achieved limited success.

Over the past several decades Bulgaria has been attempting to establish itself as the center of the natural gas route in the Balkans, but so far it has achieved limited success.

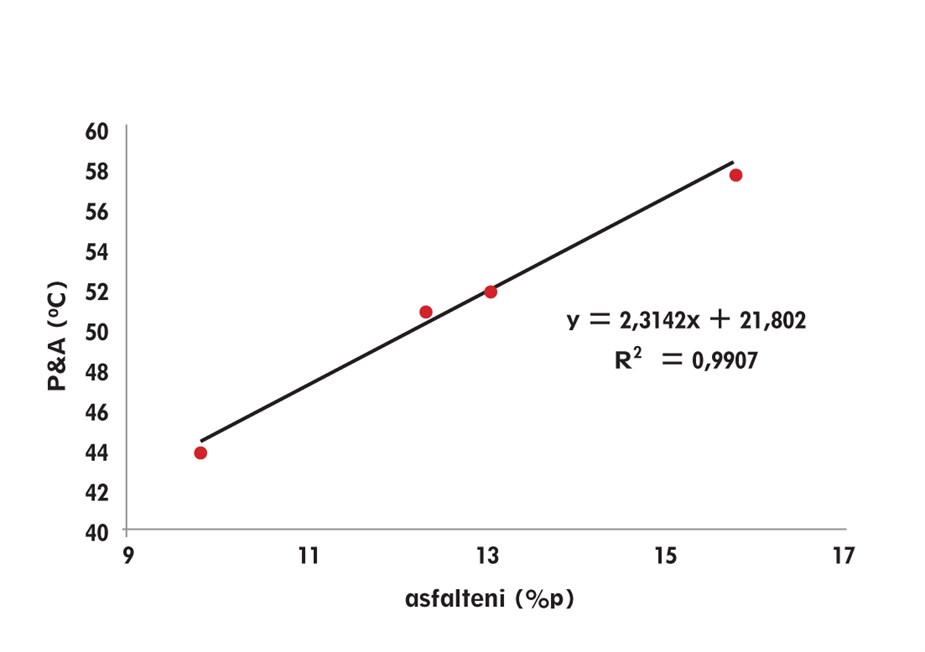

Natural gas plays a small role in the country’s domestic energy consumption. Its share of electricity generation stands at 13%, but it is widely used for district heating in urban areas. With very limited domestic supplies of gas, more than 95% of it comes from Russia. The route of the Trans-Balkan pipeline, delivering all imported gas, passes through Ukraine, Moldova, and Romania, and that is a major concern for Bulgaria’s energy security.

In the mid-2000s, Russia’s Gazprom and Ukraine found themselves in a battle over late payments and unfulfilled contractual agreements. Gazprom reduced gas deliveries to Ukraine in order to force them to pay their obligations. Ukraine then diverted volumes for domestic consumption that were supposed to be transited for Europe and the dispute reached a crescendo on January 1, 2006, when Gazprom cut down the entire supply passing through Ukraine. This resulted in disruptions for the European market in the middle of the winter heating season.

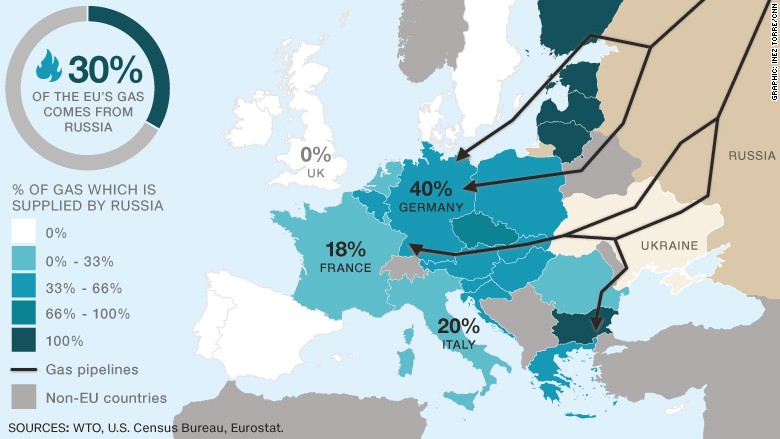

Russia controls a 30% share of the total European gas market, but for eastern and southeastern Europe, which are 100% dependent on Russian gas, this disruption was much more severe. There were other similar cut-offs in subsequent years driven by economic and political disputes even before the Crimea crisis.

Ukraine sits in the middle of the gas-transit network that delivers Russian gas to Europe – almost half of the volume supplied to western and southern Europe pass through Ukrainian territory (159.5 bcm capacity). After the disputes over eastern Ukraine and Crimea escalated into an all-out military confrontation in 2014, Gazprom announced that it plans to stop gas deliveries through Ukraine by 2019. There are several alternatives for bypassing Ukraine, but all of them require building new pipelines or expanding existing capacities.

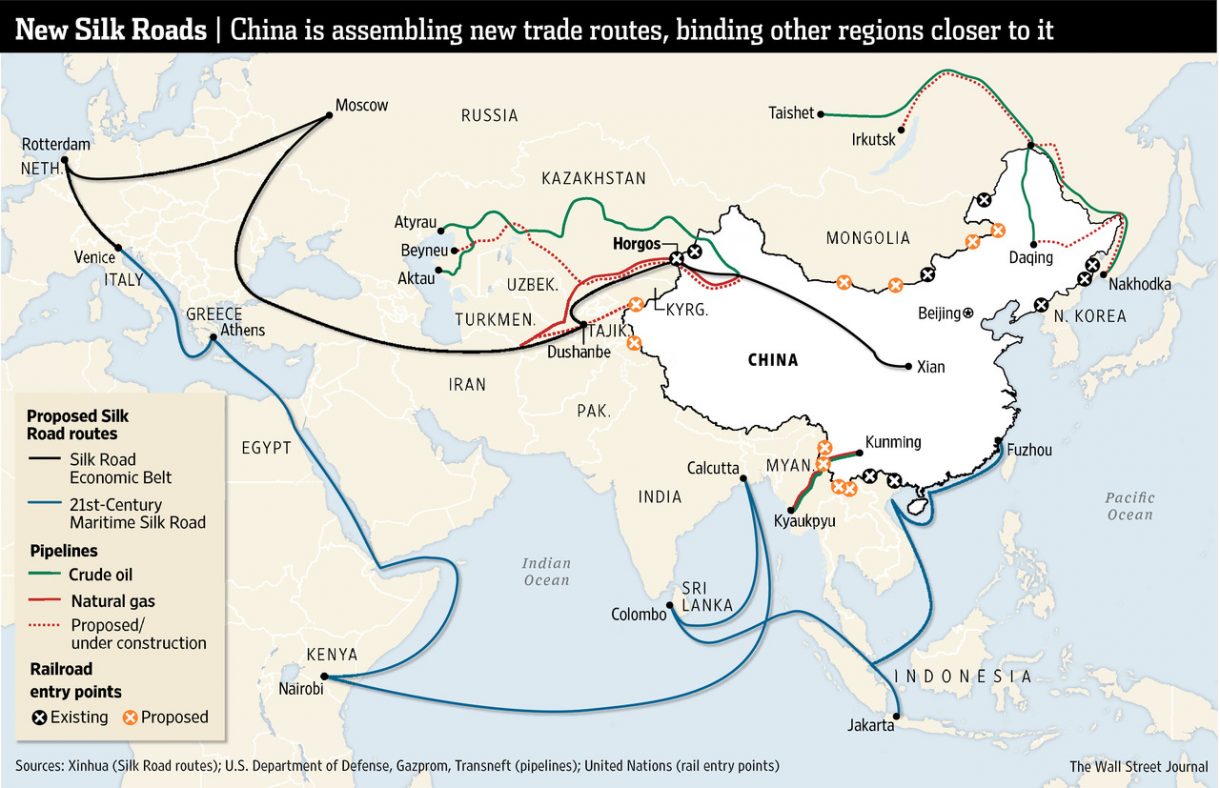

Russia has been working on several projects: Nord Stream 2 – delivering gas directly to Germany through the Baltic Sea; South Stream – delivering gas to southern Europe through the Black Sea and Bulgaria, as well as expanding the pipeline through Belarus (31.5 bcm capacity). At the end of 2014, Russia announced a freeze on its work on South Stream, citing EU regulatory obstacles and at the same time signed a memorandum with Turkey to commence building the Turkish Stream (63 bcm/year). The new project bypasses Bulgaria and sends gas to Europe through Turkey, Greece, Macedonia, Serbia and Hungary. If the project is developed as planned, Bulgaria’s dream of becoming a transit hub will not materialize. After the announced halt of transit through Ukraine in 2019, Bulgaria will also have limited options for securing gas for domestic consumption.

South Stream follows the fate of another widely touted project in the mid-2000s – the Nabucco pipeline, which was supposed to diversify European supply by bringing gas from Azerbaijan. The project was shelved, not unlike South Stream, amidst EU regulatory requirements for third party access (TPA) and by fear that Azeri supply will not be enough to meet the project requirements. The Caspian Sea connector, linking Nabucco to Turkmenistan, would have guaranteed a diversified and plentiful supply for the European market but the project never took off amidst soaring cost estimates and rival Russia-backed projects in the region. Russian opposition for the Caspian Sea connector and the fallout between Azerbaijan and Turkmenistan doomed Turkmeni access to European markets. Another possible player, albeit not in the foreseeable decade, could be Iranian gas. An additional connection between Erzrum in Turkey and Iran will have to be built, but it is not guaranteed that Russia will not use the Turkish Stream project as a leverage to prevent Turkey from bringing Iranian gas into the mix. The required pipeline will also have to pass through the restive Kurdish area, where Turkey is waging a mini-war with its Kurdish minority. Both security and political reasons may prevent the building of Iran-Turkey connections. Russia announced a few months ago that Turkish Stream gas would be delivered at 10.25% discount for domestic Turkish consumption. But there is a high probability that the Turkish Stream project will follow the fate of Nabucco or South Stream and that Russia is only using such “virtual” pipelines for political reasons. The fate of Turkish Stream is still unclear amidst the downing of a Russian military plane by Turkey near the Syrian border. Last week, the Russian energy minister Novak announced that talks with Turkey on the future pipeline are suspended. Turkey said that it was seeking alternatives for Russian gas and is looking for other suppliers, referring to Azerbaijan and Qatar. In a joint press conference, Azerbaijan’s President Aliyev and Turkish premier Davutoglu announced the speeding up of the Trans Anatolian Natural Gas Pipeline Project (TANAP). The TANAP will be connected to the Trans-Adriatic Pipeline (TAP) and will deliver gas to Europe through Greece, Albania and Italy.

Both the U.S. and the EU have interests in the diversification of European suppliers of natural gas. Cutting dependence on Russian supplies will give Europe economic and political leverage in dealing with a more aggressive and assertive Russia. Director of the Office of Energy Policy and System Analysis at the US Department of Energy Melanie Kenderdine recently met with the Bulgarian Energy Minister T. Petkova to discuss diversifying Bulgaria’s gas flow from Gazprom. The projects that were discussed involve building inter-connectors with neighboring Greece (IGB) and Romania, allowing hydrocarbon explorations along the Bulgarian coast of the Black Sea and the inclusion of Bulgaria in the Trans-Adriatic Pipeline (TAP). Russia on the other hand announced that the cancelled South Stream is not dead and Gazprom will continue certain activities on it. The problem with South Stream stemmed from the EU’s Third Energy Package requirements for allowing competitive access to the pipeline by third parties, rules prohibiting ownership of the gas, transit lines, and land by the same operator. Corruption scandals in Bulgaria also contributed greatly to the demise of the project and even forced the EU to cut financial packages for the Bulgarian government. The energy policy of Bulgaria is highly politicized and energy projects are usually dictated by pro-Russian or pro-Western interests. The press has revealed that the entire legislation accompanying the South Stream project passed by the Bulgarian Parliament has been written by Gazprom lawyers. Lack of transparency in contract allocations and project financing forced the EU to take actions against Bulgaria. The day the South Stream was cancelled by Russia, a mysterious run on Corporate Commercial Bank (KTB) ensued. It was the bank responsible for handling the government budget transactions and the financing for the South Stream pipeline. The bank became insolvent and was forced into bankruptcy. The major stakeholder and Chairman of the Supervisory Board Tsvetan Vassilev fled to Serbia and so far has avoided accountability and prosecution in Bulgaria.

Corruption scandals have long plagued Bulgarian politics and they may derail any new major infrastructure projects involving gas pipelines. It is common practice for new governments to terminate contracts signed by previous ones. Lack of political stability and continuity might prove to be the biggest threat to Bulgarian energy security.

The EU’s need for diversifying gas supply away from Russia is no more pressing than in Bulgaria. The country imports almost all of its gas from Russia via the Trans-Balkan pipeline. The route runs through Ukraine and the announcement by Gazprom that they will discontinue shipments through Ukrainian territory after 2019 will have serious consequences for Bulgaria. It is not guaranteed that Russia can afford to bypass Ukraine for now. The Ukrainian pipeline capacity of 159 bcm needs to be replaced. Nord Stream 2 will add about 55 bcm but there are no guarantees that the project will not face the same fate as South Stream. Nord Stream has been concluded as a bilateral project between Russia and Germany and has so far avoided the EU Third Energy Package requirements for competitive third party access.

The lack of interconnections between the North and South European energy markets poses a serious challenge for Bulgaria. If all the other proposed projects (South Stream, Nabucco, Trans-Adriatic Pipeline and TurkStream) remain “virtual,” then Bulgaria will be faced with limited options for securing gas supplies. The interconnector with Greece will allow it to access the LNG port in Kavala (Greece) and the TAP line bringing Azeri gas to Europe, but the 183 km section has been slow to materialize. The bad economic situation in Greece will prevent it from investing in costly new infrastructure projects. Another choice for Bulgaria will be to lift the ban on shale exploration. The ban was instituted thanks to the heavy influence of Russia through its friends in the ultra-nationalistic Ataka party. Northern Bulgaria sits on top of the Carpathian-Balkanian shale basin and there could be significant commercial quantities of domestic gas. The U.S. Energy Information Administration has estimated Bulgarian and Romanian technically recoverable shale gas at 37 Tcf. But the Russia-backed Ataka party managed to institute a ban on shale exploration through fear-mongering, organized protests, and cooperation with environmentalist groups. This virtually sealed the fate of Bulgaria as a guaranteed customer for Russian gas. Russia is also trying to stir up anti-EU frustration in Bulgaria after businesses suffered financial losses. Under pressure from the West, Bulgaria withdrew from two other major Russian-linked projects – the Belene nuclear power plant and the Burgas-Alexandroupolis oil pipeline. This has imposed heavy losses both for investors and for the government. The country needs to take a second look into its shale deposits and develop domestic sources of natural gas. Preliminary exploratory work in the Black Sea basin is being carried out currently by Royal Dutch Shell, BP and Statoil ASA. If that produces commercially viable quantities of natural gas, it will alleviate Bulgaria’s energy needs, but in the meantime the government should work to link the country to Greece and Romania in the so called ‘vertical gas corridor.’ In April 2015, the three countries signed an agreement to complete the project by 2018. It will cost about €220 million and will allow the region to work on diversification of supply.

Natural gas accounts for only 13% of Bulgaria’s energy consumption, but nonetheless the country dependence on Russia as a single source to cover the majority of its needs creates a host of energy security implications. Even if relations between the two states remain friendly, Gazprom’s decision to stop gas transit through Ukraine after 2019 poses a serious risk. None of the proposed pipeline projects – South Stream, TurkStream, Trans-Adriatic Pipeline, TurkStream or Nabucco, have so far materialized. In order to diversify its supply, the country should consider lifting the ban on shale exploration, working with Greece and Romania on the vertical gas corridor, exploring its offshore fields, trying to leverage EU funds and lobby for the connecting of the North and South European gas markets through Slovenia.

Even if some of the Russian projects move from the realm of virtual to actual gas pipelines, a diverse supply will only increase the energy security of the country.

By : Boyan Dobrev