An Assessment of Climate Change Vulnerability, Risk, and Adaptation in Albania’s Energy Sector

An Assessment of Climate Change Vulnerability, Risk, and Adaptation in Albania’s Energy Sector

Understanding Energy Sector Vulnerability

Many countries are increasingly vulnerable to destructive weather events — floods, droughts, windstorms, or other parameters. The vulnerability is driven in part by recent extremes in climate variability but also by countries’ sensitivity to events exacerbated by past practices, socioeconomic conditions, or legacy issues. The degree to which vulnerability to weather affects the countries’ economies is driven by their coping or adaptive capacities.

Seasonal weather patterns, weather variability, and extreme events can affect the production and supply of energy, impact transmission capacity, disrupt oil and gas production, and impact the integrity of transmission pipelines and power distribution networks. Climate change also affects patterns of seasonal energy demand. It is important to explore these vulnerabilities for the energy sector given its major contribution to economic development, the long life span of energy infrastructure planning, and the dependence of supply and demand on weather.

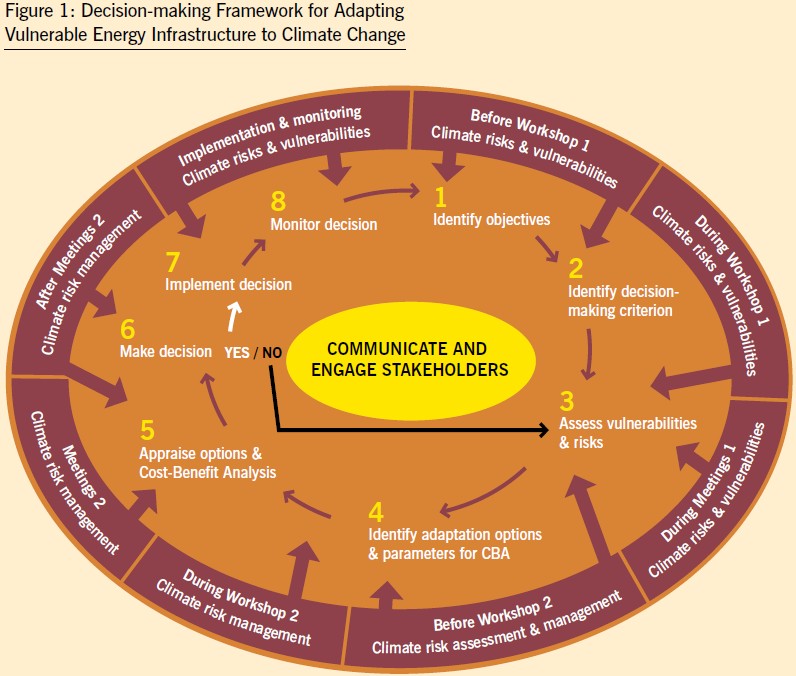

In response to these challenges, the Energy Sector Management Assistance Program (ESMAP) has developed a framework for decision-making to support adaptation of energy infrastructure vulnerable to climate change, specifically the Climate Vulnerability Assessment Framework (Figure 1). A bottom-up, stakeholder-based, qualitative/semi-quantitative risk-assessment approach is used to discuss and identify risks, adaptation measures, and their costs and benefits. It draws on experience and published guidance from the United Kingdom and Australia, as well as existing research and literature. The climate vulnerability assessment framework puts stakeholders at the heart of the decision-making process and involves:

- Climate risk screening of the energy sector to identify and prioritize hazards, current vulnerabilities, and risks from projected climate changes out to the year 2050

- Identification of adaptation options to reduce overall vulnerability

- A high-level cost benefit analysis of key physical adaptation options

This overview showcases a pilot vulnerability, risk, and adaptation assessment undertaken for Albania’s energy sector to raise awareness and initiate dialogue on energy sector adaptation. This pilot assessment demonstrates an approach that can be used to help countries and energy sector stakeholders develop policies and projects that are robust in the face of climatic uncertainties, and assist them in managing existing energy concerns as the climate changes. It identifies key direct risks to energy supply and demand and options for adaptation to establish where to focus subsequent in-depth analyses. It also identifies additional research needed to better understand the implications of extreme climatic events for the energy sector as well as potential indirect impacts — such as possible adaptation actions in the agriculture sector that may affect energy supply.

Albania’s Energy Sector is Vulnerable to Climate Change

Water Resources are a National Asset

The River Drin is the main source of electricity for Albania; delivering power for local industry and households, and providing about 90% of domestic electricity generation.1 Meanwhile, Albania’s rainfall and snow is among the more variable in Europe.2 As efforts to counter the impacts of climate change accelerate and as other countries struggle to reduce their greenhouse gas emissions, Albania’s ability to produce renewable energy will only increase in importance as a national asset.

But the High Dependence on Hydropower Brings Challenges

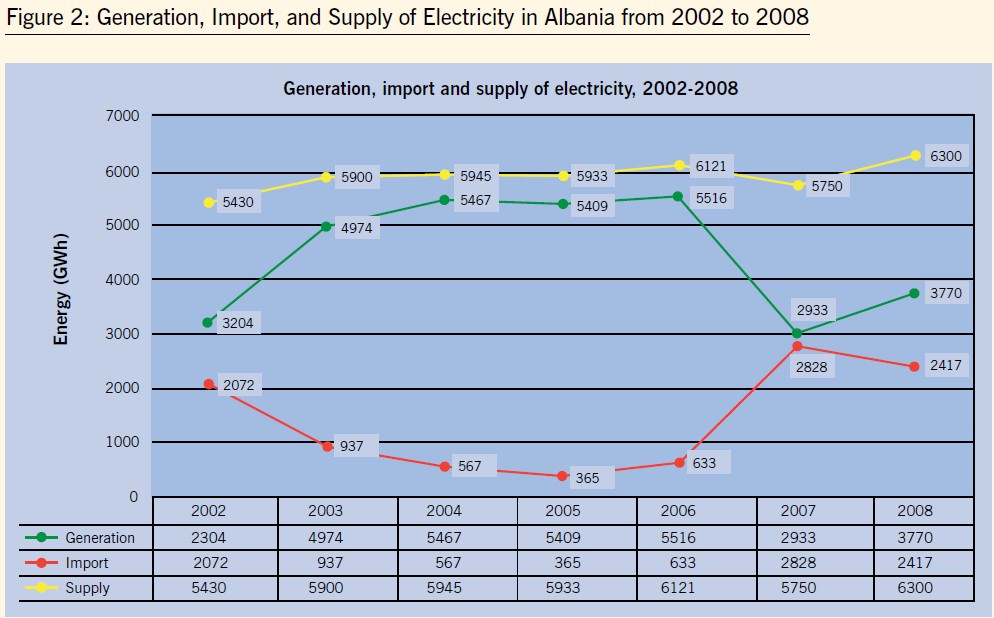

Albania already finds it difficult to meet energy demand and maintain energy supply due to the fluctuations in the country’s rainfall and other precipitation on which hydropower depends. As a result, hydropower production can vary between almost 6,000 GWh in very wet years to less than half that amount in very dry years. In 2007, a drought in the Drin’s watershed led to severe electricity shortages and blackouts, affecting businesses and citizens alike. Figure 2 clearly shows lower domestic power production linked to low rainfall in 2002 and again in 2007 with resultant associated high energy imports. It is worth noting that, even with imports, load shedding is still required so the energy consumption data in Figure 2 do not represent the true energy demand.

Other factors constrain Albania’s ability to manage these challenges, such as limited regional electricity interconnections and inefficiencies in domestic energy supply, demand, and water use. Losses in the electricity distribution system were about 33% in 2008. Together, these factors create frequent load shedding and adversely impact Albania’s economic development.

Meanwhile, small hydropower plants compete for limited water resources with the irrigation needs of the agriculture sector.3 This is exacerbated during summer when rainfall is the lowest and agriculture requires greater water supply. Improving the efficiency of water use in Albania’s irrigation system, where 10% to 20% of water resources are lost, is an adaptation mechanism that can help both sectors.

Currently, efforts are underway to address these challenges and improve resource use efficiency. For instance, the Albanian government has recently decided to eliminate load shedding from 2009 onwards and committed to provide 24 hours of electricity supply. Electricity losses from the distribution system were reduced by 5.5% in 2008 compared to 2007 and losses from the transmission system were 3% in 2008, down from 4% in 2006. The efficiency of water use in energy generation has also improved due to better monitoring and management.

Climate Change Looks Likely to Make Matters Worse, Unless Prompt Action is Take

Climate Change Looks Likely to Make Matters Worse, Unless Prompt Action is Take

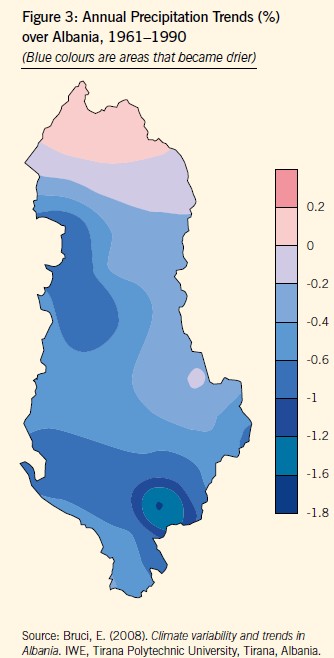

Climate forecasts project an increase in droughts resulting from global warming and changing hydrology. These changes could reduce annual average electricity output from Albania’s large hydropower plants (LHPPs) by about 15% and from small hydropower plants (SHPPs) by around 20% by 2050. Most of the country has already seen decreases in precipitation (Figure 3).

Other energy assets are not immune from climate impacts. Rising temperatures can reduce the efficiency of transmission and distribution lines, as well as the power produced by thermal power plants (TPPs) by about 1% each by 2050. If river-water cooled TPP were developed in future, these would be affected by changes in river flows and higher river temperatures, further reducing their efficiency. Owing to uncertainties in current and future wind speeds, estimates of changes in wind power generation cannot be made. Solar energy production in Albania may, however, benefit from projected decreases in cloudiness as it is estimated that output from solar power could increase by 5% by 2050.

Higher temperatures due to climate change may reduce the demand for heating in winter, but will increase demand for air conditioning and refrigeration in the summer. The seasonality of Albania’s supply-demand imbalance raises this exposure: summer temperatures increase the demand for cooling and refrigeration at the same time hydropower production is most constrained by reduced rainfall. Summer temperatures also coincide with a greater irrigation need in agriculture, which may compete directly with small hydropower plants for the limited water supplies.

Adapting to Climate Variability will become Increasingly Important for the Albanian Energy Sector

A wide range of Albanian stakeholders met regularly over eight months to tackle these questions through a collaborative assessment of vulnerability, risk, and adaptation for the energy sector. Through a series of structured workshops and meetings, they collectively identified and prioritized 20 key risks and options for managing them.

Albania’s draft National Energy Strategy (NES) sets out an ‘active scenario’ to improve energy security in the decade to 2020. It targets a majority of identified adaptations and describes plans to diversify the energy system by encouraging development of renewable energy generation assets (e.g., solar, small hydropower plants, wind, biomass) and thermal power. It notes the importance of new electricity interconnection lines, some already under construction, to facilitate Albania’s active participation in the South East European energy market. As currently drafted, the NES does not account for future climate impacts on the performance of new energy assets — neither generation nor transmission.

The draft NES does emphasize the need for improved energy efficiency through greater use of domestic solar water heating, improved building standards, use of lower energy appliances, and alternative heating sources other than electricity. These energy efficiency measures are critical and will become increasingly essential as the climate changes.

However, the draft NES should also take into account the fact that the wider region on which Albania depends for energy imports is also facing emerging climate impacts. About one quarter of the region’s electricity is generated by hydropower and regional summer energy demand will rise along with temperatures and economic development. This could increase import prices and reduce supply unless region-wide coping strategies are also devised.

Albania’s Climate Vulnerability Assessment Reveals an Energy Shortfall by 2030

Together with Albanian energy practitioners, the Climate Vulnerability and Adaptation Assessment team extrapolated the energy planning scenarios to 2050, as outlined in the ‘active scenario’ of the draft NES, to illustrate potential longer term impacts of climate change on energy supply and demand. Assuming full implementation of the measures already identified in the extrapolated ‘active scenario,’ the potential supply-demand gap was estimated at 350 GWh per year by 2030, equivalent to power generation of 50 MW. By 2050, the shortfall rises to 740 GWh per year (105MW) or 3% of total demand. Embedded within these figures are the more significant seasonal impacts on energy security due to changing demand and production over the year, with summer peak demand increasing when hydropower production is at its lowest.

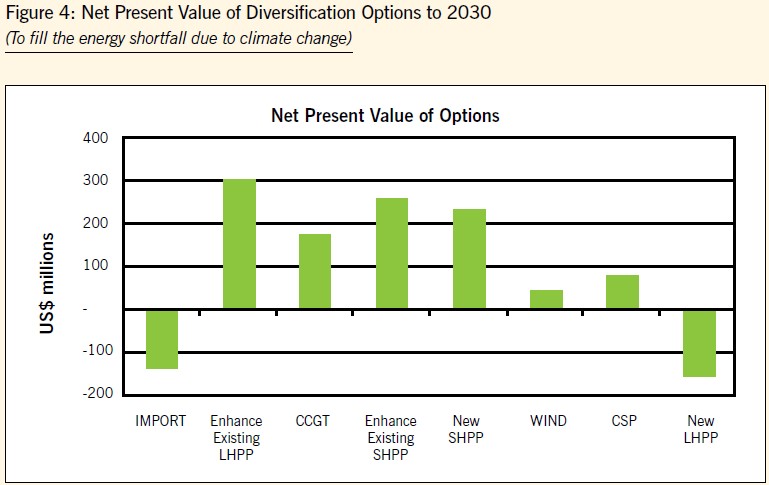

A high-level cost benefit analysis (CBA) was undertaken to estimate the relative costs and benefits to Albania of supplying the shortfall in its electricity production attributed to climate change impacts. Using financial (capital and operational costs), environmental (water value, greenhouse gas and other emissions, and ecosystem values), and social (disturbance to people and property) parameters identified by Albanian stakeholders, the CBA ranked the sustainability of their options, such as increased energy trade and different types of domestic energy generation (Figure 4).

Figure 4 presents the Net Present Value results in current (2010) US$ terms for each of the options tested, under a ‘base case’ set of assumptions for the period to 2030. Based on this analysis, the most economic options for Albania are to upgrade existing LHPPs and SHPPs in the medium term, followed by development of new SHPPs and TPPs (shown as combined cycle gas turbine, CCGT). Sensitivity analyses confirmed that upgrading existing LHPPs and SHPPs were the most economic options for discount rates in the range of 2% to 20% and, as expected, are insensitive to the value of greenhouse gas emissions.

Albania Has Options for Managing Weather and Climate Vulnerability

There are several critical actions that Albania could take now to support optimal use of energy, water resources, and operation of hydropower plants today. Enacting these steps now will help Albania better manage climate variability and build the country’s future resilience to climate change.

Improving the way that institutions monitor, forecast, and disseminate information on meteorological and hydro-meteorological conditions.

Albania could develop (in-country) or obtain (from elsewhere) weather and climate forecasts appropriate for energy sector planning, covering short-range forecasts (1-3 days), medium-range forecasts (3-10 days), seasonal forecasts, and regional downscaled climate change projections. This information could support energy sector stakeholders to undertake joint climate risk assessments across shared water resources and regional energy networks, and devise agreed strategies to manage identified climate vulnerabilities and risks.

Improving energy efficiency by reducing system losses and encouraging and helping end users to manage their demand for power.

Upgrading Emergency Contingency Plans (ECPs) for hydropower plants where needed, to account for expected increases in precipitation intensity due to climate change. Power producers and local authorities may also need to improve their capacities to implement ECPs, ensuring that they provide sound mechanisms for monitoring weather and its influence on river flows and reservoir levels, as well as communication with downstream communities, and contingency plans for evacuation.

Ensuring the management and development of water resources integrates all sectors energy, agriculture, water supply and sanitation, and cross-border concerns along with environmental and social concerns.

Exploring further adaptation opportunities. Climate change emphasizes the imperative to increase the diversity of its energy supplies through increased regional energy trade and a more diverse portfolio of domestic generation assets. With major investments in upgrading new energy assets on the horizon, and the privatization of assets, the earlier climate risks are considered, the greater the opportunities to identify and implement solutions that make the energy system more robust and resilient for coming decades.

While TAP pipeline construction has started, Albania will become part of the international gas network, paving the need for gasification of the country with a network of special and brand new. This project requires huge investments that lie in years, while the master plan for the gasification is underway and expected to be ready next October.

While TAP pipeline construction has started, Albania will become part of the international gas network, paving the need for gasification of the country with a network of special and brand new. This project requires huge investments that lie in years, while the master plan for the gasification is underway and expected to be ready next October.