Cashing In On Pieces Of The Caspian Jigsaw

The landlocked Caspian Sea is one of the oldest oil producing regions in the world and growing its reputation as a gas producer, but the region poses a unique set of challenges to companies looking to develop its reserves. Bordered by Kazakhstan, Russia, Azerbaijan, Iran and Turkmenistan, the Caspian Sea is the largest enclosed body of saltwater in the world.

The landlocked Caspian Sea is one of the oldest oil producing regions in the world and growing its reputation as a gas producer, but the region poses a unique set of challenges to companies looking to develop its reserves. Bordered by Kazakhstan, Russia, Azerbaijan, Iran and Turkmenistan, the Caspian Sea is the largest enclosed body of saltwater in the world.

Despite the logistical difficulties of access and infrastructure, however, a swathe of projects are underway offshore the main producing countries. With sanctions being lifted on Iran, activity also is expected to pick up there in the coming years.

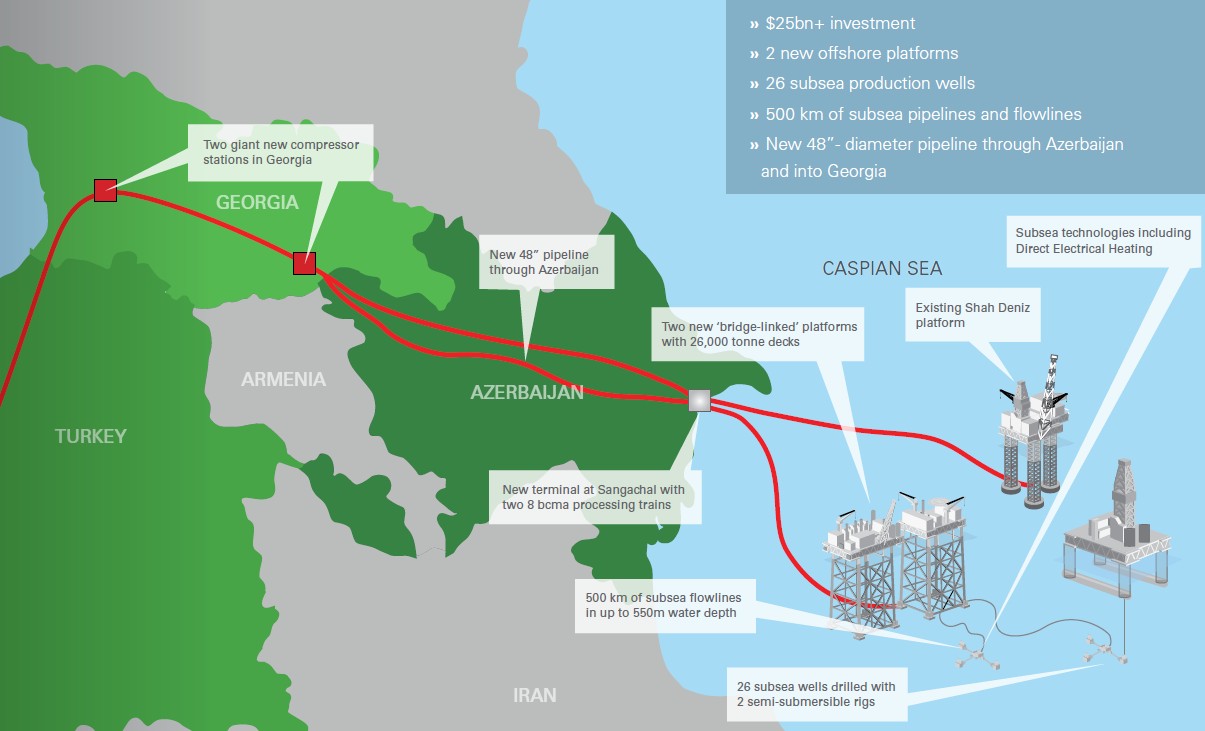

In the Azeri sector of the Caspian, most oil production comes from the BP-operated Azeri-Chirag-Gunashli field complex, while Shah Deniz, Azerbaijan’s biggest gas field, is being developed by BP, Statoil, Azeri state energy company SOCAR and the South Caucasus Pipeline Co.

The project is in development of the second phase, which includes offshore drilling and completion of 26 subsea wells and construction of two bridge-linked platforms. And onshore there will be new processing and compression facilities at Sangachal.

About 16 Bcm/year (565 Bcf/year) of gas produced from the Shah Deniz Stage 2 project will be carried some 3,500 km (2,175 miles) to provide energy for millions of consumers in Georgia, Turkey, Greece, Bulgaria and Italy.

First gas is targeted for late 2018, with sales to Georgia and Turkey. First deliveries to Europe will follow about a year later.

Condensate production from the Shah Deniz Field is expected to increase to 120 Mbbl/d from current levels of about 55 Mbbl/d.

The final investment decision for the project was taken in 2014 and triggered plans to expand the South Caucasus Pipeline (SCP) through Azerbaijan and Georgia, to construct the Trans Anatolian Gas Pipeline (TANAP) across Turkey and to construct the Trans Adriatic Pipeline (TAP) across Greece and Albania and into Italy.

Together these projects will create a new Southern Gas Corridor to Europe. The total cost of the Shah Deniz Stage 2 and SCP expansion projects will be about $28 billion. Technip has been awarded a contract by TAP for the onshore part of the pipeline from Greece to Albania and in Italy.

The project scope includes an about 870-km-long (540-mile-long) pipeline, which will start from the tie-in with the TANAP portion of the Southern Gas Corridor project at the Greece/Turkey border.

The pipeline will then go through Greece and Albania to eventually cross subsea in the Adriatic Sea and end in Puglia, Italy, where it will connect to the Italian natural gas network.

TAP is designed to transport 10 Bcm/year (353 Bcf/year) with a potential future expansion to 20 Bcm/year (706 Bcf/year) as more gas becomes available.

FMC Technologies will supply subsea production systems for well clusters 3-5 of the Shah Deniz Stage 2 project in a deal worth $297 million.

Another $66 million contract for the second of three planned batches of subsea production trees and ancillaries required for the full-field development was awarded to OneSubsea. The delivery of equipment will take place from 2016 to 2021.

Shah Deniz is not the only major project underway in the Azeri sector of the Caspian, with Total teaming up with SOCAR to develop the Absheron gas field, which the French operator sees starting up in 2021.

Total and SOCAR formed a joint venture (JV) in 2009 to explore and develop the Absheron Field, which has estimated reserves of 350 Bcm (12 Tcf) of gas and 330 MMbbl of gas condensate.

Block Absheron lies under about 500 m (1,640 ft) of water in the Caspian Sea and is 100 km (62 miles) from Baku.

The field was discovered in 2011 and contains between 141 Bcm and 283 Bcm (5 Tcf and 10 Tcf) of gas resources.

Total and its partners have completed the FEED for the project.

The FEED process started in summer 2014 and was concluded in July 2015.

Various commercialization options for the natural gas have been studied. It could be transported via the SCP, in which Total holds a 10% equity stake.

“The final investment decision is expected to be made in the fourth quarter of 2017, and the first commercial drilling [is scheduled to] start in the fourth quarter of 2019,” Eric Meyer, Total’s planning development manager, said. “So the first gas will be produced in the fourth quarter of 2021.”

Four wells are expected to be drilled on the field by two rigs. The first of them will be drilled by a new semi-submersible floating drilling rig, which is now under construction by SOCAR.

Total and SOCAR both hold 40% stakes in the JV. French group GDF Suez, which joined the project later, owns 20%.

Limited rig access

One of the problems faced by companies operating in the Caspian is a lack of access to drilling rigs.

SOCAR is constructing the new Caspian Driller semisubmersible rig designed for drilling wells at depths up to 8,000 m (26,247 ft) and in water depths of 1,000 m (3,281 ft). The rig is expected to be completed in 2016.

The cost of the new-generation rig construction project in Azerbaijan is $1.116 billion.

The Caspian Drilling Co. (CDC), 92.44% of which is owned by SOCAR, will act as an operator of the rig.

Singapore’s Keppel FELS Ltd. became a construction contractor for the plant and signed an agreement on construction with CDC in June 2013.

The rig also will be used for drilling on other fields in the Azeri sector, including the Umid Field and the Babek, Karabakh and Ashrafi prospects. It is expected to start operations off Turkmenistan.

In a bid to overcome the limited rig supply in the Caspian, drilling contractor Eurasia Drilling Co. Ltd. (EDC) has used novel methods to get its rigs into the region.

It is now the largest offshore drilling contractor operating in the jackup market of the Russian, Kazakh and Turkmen sectors.

The company owns and operates three of the four jackups operating in these sectors: the Astra, Saturn and Neptune rigs. The company’s new Mercury jackup is completed and undergoing certification and licensing in the Turkmen sector before startup of operations.

The job of getting the Mercury rig from Sharjah where it was built to the Caspian was a complex one.

The rig was built as a Lego kit, fitted together and then sectioned out, enabling it to be shipped on the Volga Don Canal and then put back together at the CNRG shipyard in Astrakhan.

One of the main challenges was to fit the Volga-Don width restrictions. The central hull sections, for example (the largest single modules), cleared the canal by only 6 in. on either side.

The main hull for the Neptune, a LeTourneau Super 116E, was preassembled at the Lamprell yard in Sharjah in the United Arab Emirates (UAE) and then sectioned into seven pieces, including two central sections, two side sections and three leg well sections.

The legs for the rig were preassembled in the UAE as full rounds, with 13 sections per leg plus the spud can, which also included a small leg section.

The accommodation and rig package were then all shipped to the Caspian in kit form and assembled onsite with the exception of the cantilever, which was prebuilt in the UAE.

The helideck, upper pipe deck and a few other small items were built in the Caspian.

In addition to the Mercury newbuild rig there are another two jackups under construction in the Caspian, one of which is the Caspian Driller newbuild rig.

The second jackup is the Prime Exerter owned by Ezion Holdings. The 33-year-old Prime Exerter was dismantled in Holland so it could be shipped into the Caspian Sea through the Volga-Don Canal system. It has been reassembled in Baku.

EDC believes seven or eight jackups are required to keep up with drilling demand in the Caspian Sea due to the large number of exploration licenses yet to be drilled.

Further discoveries would lead to more development drilling on top of the already heavy workload EDC is seeing for its rigs.

During first-half 2015 the Astra jackup rig drilled a well for the N Operating Co. in Kazakhstan followed by a well for Lukoil in the Russian Sector.

The Saturn jackup was also busy, drilling two wells for Petronas in Turkmen waters, where the Neptune jackup also drilled three wells for Dragon Oil.

EDC also drilled and completed three wells on Lukoil’s Yuri Korchagin Field platform in the Russian sector before commencing coiled-tubing workover operations on a fourth well.

Russia eyes Caspian

With its vast oil and gas reserves, Russia has plenty of projects to choose from, but energy officials believe the Russian sector of the Caspian Sea could prove critical to its energy security.

Lukoil discovered six large oil and gas fields in the North Caspian between 1999 and 2005: Khvalynskoye, Yuri Korchagin, 170th Kilometer, Rakushechnoye, Sarmatskoye and Filanovsky.

The fields are thought to contain nearly 5 Bbbl of 3P (proven, probable and possible) reserves.

The Vladimir Filanovsky oil and gas field is the biggest by oil reserves discovered in Russia in the last 20 years, while another 10 prospective oil and gas structures have been identified in the North and Central Caspian.

The Vladimir Filanovsky Field was discovered in 2005 and contains 487 MMboe of proven reserves.

Development work is ongoing, and production from the field is scheduled to commence in late 2015 or early 2016 at a rate of 210,000 bbl/d.

Field facilities consist of an ice-resistant platform, a living quarters (LQ) platform and central processing platform.

The topside sections of the central processing platform and the LQ module were transported to the field in second-half 2014. The topsides for all four platforms and the catwalk bridges are currently being assembled.

Azat Shamsuarov, Lukoil’s senior vice president for oil and gas production, said, “The Vladimir Filanovsky Field development is being implemented in strict compliance with the schedule. Lukoil’s program for Caspian Sea development is a long-term one, and we are quite convinced that it will promote the development of shipbuilding and related industries in southern Russia.”

Another of Lukoil’s major producing fields is Yuri Korchagin, the country’s first offshore field in the Caspian Sea. Field infrastructure includes an ice-resistant fixed platform (LSP-1) built at the Astrakhansky Korabel shipyard and intended to drill and operate wells as well as collect and pretreat reservoir content.

The LSP-1 has a 560-mt rig capable of drilling up to 7,400-m (24,278-ft) wells.

Field construction will include 26 production wells, three water injectors and one gas injector.

Kashagan stalled

In the Kazakh sector of the Caspian Sea, the giant but troublesome Kashagan oil field is at the heart of development

plans.

Discovered in 2000, it is the largest oil field outside the Middle East. But development of the field has experienced significant delays and considerable cost overruns, with a $50 billion price tag now being put on the scheme.

The figures for oil-in-place range between 30 Bbbl and 50 Bbbl, with an average oil-in-place estimate of about 38 Bbbl. With a relatively low recovery factor of between 15% and 25% due to the complexity of the reservoir, the recoverable reserves figure is presently placed between 7 Bbbl and 13 Bbbl.

IP began in 2013 but just a few weeks later output had to be shut in because of leaks in the 28-in.-diameter pipelines transporting the sour gas 90 km (56 miles) to shore from the processing facilities installed on the artificial “Island D” hub, where the recovered liquid and gas are separated.

The highly corrosive gas has been blamed for the leaks, with the owners agreeing to completely replace the pipeline network (it is estimated to be about 200 km [124 miles] in total) with higher grade, more expensive materials.

Earlier this year Saipem, through its subsidiary ERSAI Caspian Contractor, was awarded a major new $1.8 billion engineering and construction contract for the Kashagan Field project.

Saipem will construct two 95-km (59-mile) pipelines that will connect Island D in the Caspian Sea to the Karabatan onshore plant in Kazakhstan.

The scope of work includes the engineering, welding materials, conversion and preparation of vessels, dredging, installation, burial and precommissioning of the two pipelines. The two pipelines, with a diameter of 28 in., are made of carbon steel internally cladded with a corrosion-resistant alloy layer. Construction will be completed by year-end 2016 and startup of the field is anticipated in 2017.

Eni has a 16.8% stake in the consortium developing the field. Other partners include Shell (16.81%), Total (16.81%), Exxon Mobil (16.81%), KazMunayGas (16.81%), China National Petroleum Corp. (8.4%) and Inpex (7.56%).

Until Kashagan starts up again, the largest source of oil production in Kazakhstan is the giant Tengiz oil field, discovered in 1979.

In Turkmenistan, most of the country’s oil reserves are located offshore or in the Garashyzlyk area west of the country.

The Cheleken project has been under development since the mid-1990s, with the UAE’s Dragon Oil acting as operator.

Proved and probable reserves in the contract area are about 3 MMbbl of oil and 84 Bcm (3 Tcf) of natural gas.

In 2014 Dragon Oil completed 14 development and appraisal wells: 13 in the Dzheitune (Lam) Field and one in the Dzhygalybeg (Zhdanov) Field. Four drilling rigs are operational in the Cheleken Contract Area.

The final piece of the Caspian jigsaw is Iran, where there is currently no significant production. Iran estimates, however, that there are 100 MMbbl of oil reserves in the Sardar Jangal Field discovered in 2011.

The Iranian Oil Ministry plans to establish a refinery on the Caspian coast and supply it with crude oil from the Sardar Jangal Field, although any development in this area is likely years away, according to the International Energy Agency.

What appetite Iran will have to produce Caspian oil now that sanctions are being removed remains to be seen.