solar-calculator

Calculadora solar: calcula tú mismo tu sistema fotovoltaico

|

Gergely Gulyás, chief of staff of Hungarian Prime Minister Viktor Orbán, revealed today that integrated oil and gas company MOL, headquartered in Budapest, is conducting talks about the possibility of taking over an ownership stake in NIS – Naftna industrija Srbije. Speaking at a media briefing, he added that it is in the Serbian company’s interest to end Russian ownership, pointing out that US sanctions are jeopardizing its operations.

NIS, which runs the only refinery in the country and a service station chain, hasn’t received any oil in a month and a half. The facility, located in Pančevo near Belgrade, is about to halt its operations. NIS came under sanctions because it was majority-owned by Gazprom Neft.

Its parent company Gazprom later reduced Gazprom Neft’s stake to 44.5% and switched the remainder to another subsidiary. The US apparently demands a complete Russian exit.

Gulyás clarified that MOL, a public company, is the one in discussions about a potential stake purchase – not the government. Notably, Hungary controls the company indirectly, through several entities.

The government is ready to help neighboring Serbia with regard to a deal with MOL, the official stressed. Gulyás didn’t confirm or deny speculation that his prime minister would travel to Moscow tomorrow to meet with Vladimir Putin.

Orbán visited Serbia and met with President Aleksandar Vučić today. The Hungarian leader, who managed to get an exemption earlier from the US sanctions on Russian oil and gas, said he would engage in negotiations “in the coming days or tomorrow” to secure the actual supply and “not just papers and permits.”

Russian oil and gas will continue to flow to Hungary, so Serbia will be getting it, too, Orbán claimed.

According to earlier media reports, Abu Dhabi National Oil Co. (ADNOC) from the United Arab Emirates is among the suitors for NIS.

Serbia has asked the US to suspend sanctions for 50 days. Vučić said the government would take over NIS if a buyer isn’t found.

Hungarian Minister of Foreign Affairs and Trade Péter Szijjártó said yesterday that MOL’s fuel deliveries to Serbia have been doubled and that they would be 2.5 higher in December on an annual scale.

Gulyás denied that the increase in exports to the neighboring country would disturb domestic supply.

Energy infrastructure is the backbone of the energy system. Yet the EU’s energy network remains insufficiently integrated, and investment levels fall short of what is needed, a situation that directly affects household energy bills.

Ageing infrastructure and limited interconnection capacity are creating bottlenecks that slow the energy transition. Although some progress has been made within the existing EU legislative framework, the level of interconnection among member states remains inadequate. Several countries are not on track to meet the 15% interconnection target by 2030.

To address these challenges, the European Commission has presented the European Grids Package and Energy Highways initiative. The aim is to enable a more efficient flow of energy across the EU, integrate greater volumes of renewable energy into the system, and accelerate electrification.

Jørgensen: A truly interconnected energy system is the foundation of a strong and independent Europe

The Grids Package is designed to speed up permitting and ensure a fairer distribution of costs for cross-border infrastructure. It should also improve the use of existing infrastructure and accelerate the development of networks and other physical energy assets across the EU.

Among the measures is a new mechanism that allows the commission to initiate the search for additional infrastructure projects when existing initiatives do not cover identified cross-border needs.

“A truly interconnected and integrated energy system is the foundation of a strong and independent Europe. To achieve it, we need an energy infrastructure network of cables, pipes and grids that is up to date, fully interconnected, and that enables clean, affordable, homegrown energy to flow freely and securely to every corner of our union. This is exactly what we are proposing today: a common European energy project that supports affordable living, economic competitiveness, security, and decarbonisation,” said Dan Jørgensen, European Commissioner for Energy and Housing.

Slow permitting remains one of the biggest bottlenecks for energy infrastructure and renewable energy projects in the EU.

Obtaining permits for transmission infrastructure currently takes more than five years on average, while renewable energy projects may face delays of up to nine years.

The Grids Package introduces simplified and accelerated permitting procedures. The commissioners have proposed setting time limits within which decisions must be taken for all types of projects. If the competent authority fails to respond within the deadline, the permit would be considered granted.

Permits for smaller projects would be issued through faster and more streamlined procedures

Permits for smaller projects would be issued through faster and more streamlined procedures. All processes would have to be fully digitalised, and national administrations would be required to have adequate staffing and technical capacity to process applications.

The commission is proposing to move away from the current first-come, first-served model and introduce a system that ensures timely and non-discriminatory access to the grid, one that balances social acceptance and industrial competitiveness.

According to the commission’s estimates, EUR 1.2 trillion in investment will be needed for Europe’s electricity grid by 2040. Distribution networks account for EUR 730 billion within the sum, compared to EUR 240 billion for hydrogen infrastructure.

The commission said additional financing tools are required, including cost-sharing arrangements, arguing that cross-border infrastructure generates benefits that extend beyond the territory in which a project is located.

Another suggested solution is the formation of project firms (special purpose vehicles – SPVs) to attract additional private investment.

Given that grid infrastructure is largely financed through network tariffs, part of the burden falls on consumers. To ease this pressure, the commission announced it would boost financial support through the Multiannual Financial Framework (MFF), the EU’s regular seven-year budget, including a significant expansion of the Connecting Europe Facility (CEF). The tool is designed to support investments in new cross-border energy infrastructure and upgrades or rehabilitation of existing assets.

The current 2021–2027 EU budget contained EUR 5.8 billion for cross-border projects under CEF. For the 2028–2034 period, the commission said the amount would be raised almost fivefold, to EUR 29.91 billion.

On the private side, the EU is working on its Clean Energy Investment Strategy, to launch it in 2026 by outlining measures for private sector participation including institutional investors, as well as additional support from the European Investment Bank (EIB).

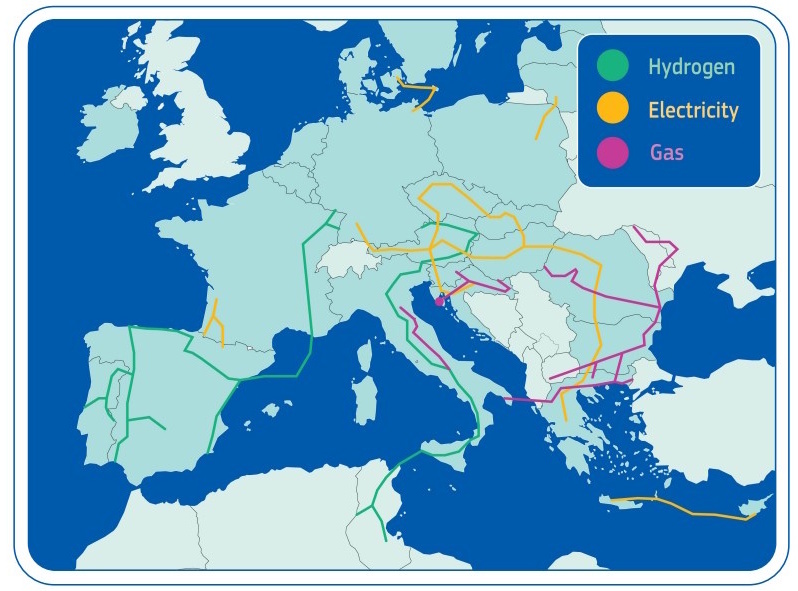

The Energy Highways initiative comprises eight of the EU’s largest and most critical infrastructure projects, essential for energy security, renewable energy integration, and cross-border electricity market connectivity.

They have already been already listed as Projects of Common Interest (PCI) or Projects of Mutual Interest (PMI), but under the new initiative, they would receive elevated political priority, accelerated financing, and faster permitting.

Among the projects are the reinforcement of interconnections across the Pyrenees to improve the integration of the Iberian Peninsula, the connection of Cyprus with continental Europe through the Great Sea Interconnector, as well as an upgrade of electricity links between the Baltic states, including the Harmony Link to Poland, which is essential for the full synchronisation of the region with the European grid.

The commission has also endorsed the establishment of Denmark’s hub on the island of Bornholm, which could, in the coming years, be connected to additional locations in the Baltic Sea.

Among the priorities are strengthening energy storage capacity in South-Eastern Europe

Among the priorities are strengthening energy storage capacity in South-Eastern Europe, as well as the modernisation of the Trans-Balkan Pipeline (TBP) for gas.

The list includes two hydrogen corridors. The southern one would connect Tunisia, Italy, Austria, and Germany, and the south-western corridor is a planned link between Portugal, Spain, France, and Germany. The commission has announced strong coordination and political support for the latter.

The commission views these projects as pillars of Europe’s future energy network, essential for lower electricity prices, greater system stability, and reduced dependence on fossil fuels.

In a regular legislative procedure, the proposals now move to the European Parliament and the Council of the EU for further deliberation.

The move follows a report by the European Union Agency for the Cooperation of Energy Regulators (ACER) concerning the formation of wholesale prices during the period between July and September 2024.

The body focused on Greece, since it is the only country in the region of Southeast Europe for which detailed market data was available from the power exchange about the offers from producers and the supply-demand curves.

ACER has called national authorities to conduct a market probe to find out whether manipulation and capacity withholding took place during the hours with the most extreme prices.

In its announcement, HCC said it was looking into possible horizontal deals or harmonized practices between companies, with the goal of preventing, limiting or degrading competition. It is focusing especially on capacity withholding and dominant market position abuse. It explained, however, that the checks do not predetermine the outcome of the procedure.

RAAEY pointed out that the goal of its probe is to protect consumers and enforce the Regulation on Wholesale Energy Market Integrity and Transparency (REMIT).

According to Energypress, HCC conducted raids and collected data from three particular companies, namely Public Power Corporation (PPC), Heron and Enerwave (formerly Elpedison).

In fact, authorities are examining not just the three-month period of last year, but also market operations in 2025.

Industrial consumers in Greece have been claiming for the past year that there is manipulation in the market, leading to inflated prices. They have called for an investigation and interventions to restore transparency.

“ACER‘s findings are not compatible with normal market player behavior as part of the Target Model,” commented the Chairman of the Hellenic Union of Industrial Consumers of Energy (UNICEN), Antonis Kontoleon.

The main threats to the energy sector in Slovenia are floods, fires, storms, landslides, sleet and wet snow, heatwaves, and drought.

The assessment of climate vulnerability and risks for the energy sector was produced in line with the IPCC AR5 methodology and the national guidelines of the Faculty of Biotechnology.

The greatest threat to the energy sector are floods, which jeopardize fuel storage, substations, electricity distribution networks, and other elements of the supply chain, the ministry underscored.

The most important subsystem is liquid fuels

By using weighting and considering the current energy mix and the state of infrastructure, the most important subsystems for the functioning of the overall system are liquid fuels (34%) and electricity (33%), followed by natural gas (18%), solid fuels (10%), and heat (5%), the assessment reads.

This reflects a high dependence on imported liquid fuels and the key role of electricity in all consumption sectors, the ministry explained.

The overall weighted vulnerability score for the energy sector is 2.3 on a scale of one to five, with the electricity subsystem having the highest vulnerability, 2.6.

Electricity distribution grids, solar power plants, and fuel transport and logistic routes also show high vulnerability, according to the assessment.

Subsector ratings:

Regarding individual elements of the sector, the most vulnerable are the electricity distribution network (3.5), electricity transmission system and imports (3), preparation of firewood, wood chips and pellets, and photovoltaic plants (3); vehicles/tanks for liquid fuels and vehicles/trucks for solid fuels, fuel stations, and other renewable energy sources (2.5).

The assessment reveals that Slovenia’s energy sector comprises critical elements whose failure could lead to significant supply disruptions.

It provides a technical basis and starting point for preparing a climate change adaptation strategy and for drafting measures such as strengthening infrastructure resilience, reviewing planning for new facilities, and incorporating climate risks into strategic documents and investment plans, according to the ministry.

Climate change scenarios indicate that the already identified risks will intensify in the future – especially floods, storms, and heatwaves.

The ministry said it would be necessary to implement adaptation measures to ensure a reliable energy supply.

Dalekovod said it signed a EUR 19.7 million contract with MEPSO, the transmission system operator of North Macedonia, as the lead member of a consortium that includes Elnos BL and Kodar Energomontaža.

The contracted works include the delivery and construction of a 400 kV power line from the 400/110 kV Bitola 2 substation, via the 400/110 kV Ohrid substation, to the North Macedonia – Albania border.

The project ensures long-term stability of the electricity system in the wider region

The new Ohrid substation is currently under construction, with Končar, another Croatian company, as contractor. Končar is the majority shareholder of Dalekovod since 2022.

The Croatian firm pointed out that the new power line in North Macedonia represents a significant infrastructure project ensuring long-term stability of the electricity system in the wider region.

Dalekovod: Strengthening position in the regional and European market

Construction is scheduled for completion by mid-2028.

Of note, all three companies are active on the territory of former Yugoslavia, as well as across Europe and even worldwide. The owners of Elnos and Kodar are individuals from Bosnia and Herzegovina and Serbia, respectively, while the largest shareholders of Dalekovod are the Government of Croatia and three foreign banks operating in the country.

Dalekovod has subsidiaries in six countries, including Namibia. In October, the company concluded a EUR 100 million deal for the construction of a 400 kV power line in Sweden.

Elnos BL is part of Elnos Group based in Banja Luka, Bosnia and Herzegovina. The company, which recently marked a remarkable dual jubilee – 80 years of tradition and 30 years of modern business development, operates in 18 countries.

A week ago, it signed a contract with Power China Construction Group to build a connection to the transmission grid for the 300 MW Vetrozelena wind farm in Serbia.

Kodar Energomontaža, headquartered in Serbia’s capital Belgrade, has carried out numerous projects across Europe – from southeastern Balkans to Scandinavia, as well as in West Africa.

In March, the company inked a deal with Serbia’s transmission system operator Elektromreža Srbije (EMS) for the construction of a two-system 400 kV transmission line, part of the Trans-Balkan Electricity Corridor.